Canada’s corporate tax system explained

As an advanced economy, Canada has a well-refined tax system both at the corporate and personal level. For investors and companies looking to expand in Canada, Canadian domiciled companies have at their disposal a range of programs and incentives. Some of these incentives are designed to promote activities in Canada such as research and development, manufacturing, and the adoption of clean energy equipment.

Prior to the Constitution Act of 1867, one of the founding documents of Canada, taxes were levied largely on trade and export activities. Fun fact: “the first recorded tax in Canada appears to date back to 1650. An export tax of 50% on all beaver pelts, and 10% on moose hides, was levied on the residents of New France”.

As the world changes, Canada has evolved its approach to taxation in an effort to simplify the system and discourage certain behaviours or encourage others, all with the goal to better our society. These revenues collected by the government help pay for vital infrastructure and many other services enjoyed by Canadians, including universal healthcare, a relatively low amount of tolled infrastructure compared to other countries, and affordable and extensive public transit systems in many major cities. This leads to Canada having a high standard of living and quality of life. Based on all of this, one would therefore assume that Canada would be a high tax environment compared to its peers. Nothing could be further from the truth.

Canada’s Marginal Effective Tax Rate (METR)

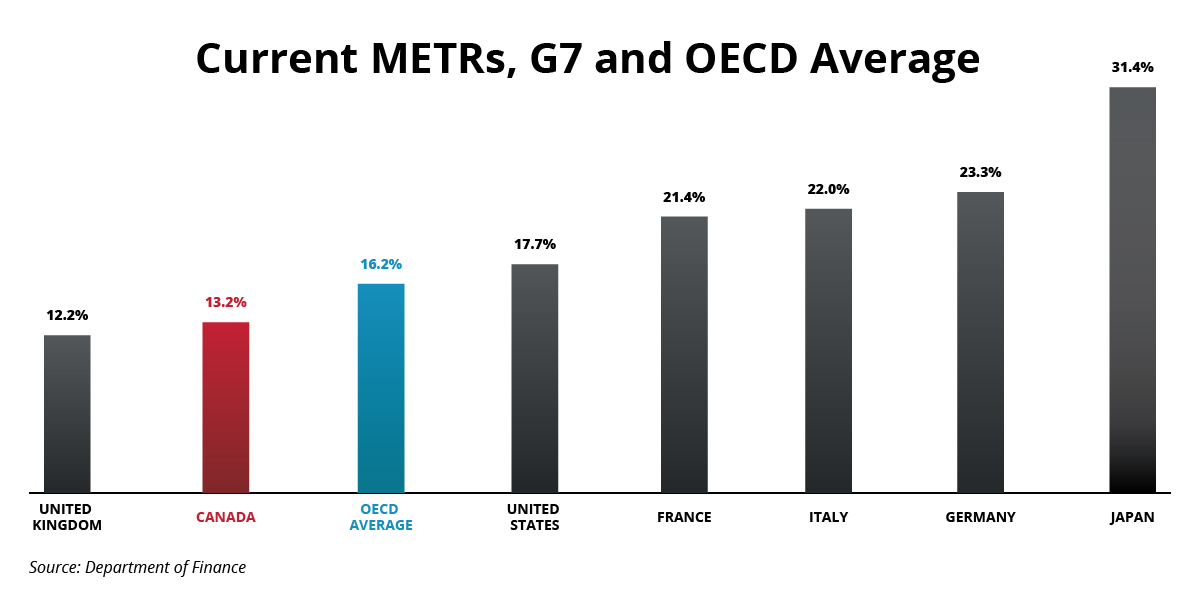

The Marginal Effective Tax Rate (METR), which provides a broad indication of overall tax competitiveness, balancing the impact of tax costs against incentives to investments, has fallen in Canada in recent years and ranks favourably among other countries. In 2021, Canada had the second lowest METR in the G7 (13.2%), after the UK (12.2%). Canada’s METR is well below the Organisation for Economic Co-operation and Development (OECD) average (16.2%).

Text version

Current METRs, G7 and OECD Average

| United Kingdom | 12.2% |

|---|---|

| Canada | 13.2% |

| OECD Average | 16.2% |

| United States | 17.7% |

| Italy | 22.0% |

| France | 22.3% |

| Germany | 23.3% |

| Japan | 31.4% |

Source: Department of Finance

Tax incentives and programs

The competitiveness of Canada’s METR is due in part to recently introduced measures aimed at incentivizing investment in production and innovation across the country. Canada has made the decision to incentivize these activities to ensure companies are able to invest in the most efficient equipment and latest technologies in order to remain competitive in the global marketplace.

Accelerated Depreciation

The federal government offers a variety of temporary tax incentives to accelerate business investment. The first measure, and most broadly applicable, is the Accelerated Investment Incentive, which allows businesses to claim up to three times the amount of the deduction normally applicable in the first year for specified capital expenses subject to capital cost allowance rules. To encourage investment in new manufacturing equipment, thus improving productivity and competitiveness of Canadian made goods, immediate expensing (i.e. full expensing in the first year) is provided for machinery and equipment used for manufacturing and processing (Class 53). To support investments in clean technologies, immediate expensing also applies to clean energy equipment (Classes 43.1 and 43.2) such as solar panels, wind turbines and electric vehicle charging stations, as well as zero-emission vehicles and automotive equipment (Classes 54, 55, and 56). These measures will be gradually phased-out starting in 2024 and will no longer be in effect for investments put in use after 2027.

Example:

A manufacturer making vehicle parts invests in new production equipment to improve the quality and quantity of parts manufactured, and also invests in clean energy equipment for its facility and electric vehicle charging stations in its parking lot. Assume equipment is $3 million and energy upgrades are $1 million and all other equipment has been fully depreciated for tax purposes.

| Sample Income Statement – All figures in $‘000s | |

| Revenue | $50,000 |

| Cost of goods sold | $35,000 |

| Operating expenses, salaries, interest, etc. | $10,000 |

| Income before taxes | $5,000 |

| Accelerated Capital Cost Allowance | $4,000 ($3,000 + $1,000) |

| Taxable Income | $1,000 |

In this simplified example, the taxable income is reduced by 100% of the capital cost of the eligible machinery and clean energy equipment.

There is no application needed to apply to the Accelerated Investment Incentive program. It is available to any company doing business in Canada. Check with the team that manages your tax filings.

Scientific Research and Experimental Development (SR&ED) Tax Incentive Program

To further encourage and support companies that engage in research and development (R&D) activities in Canada, the SR&ED tax incentive program provides a 15% non-refundable tax credit on qualified expenditures to non-CCPCs (Canadian-controlled private corporations).

Eligible activities include: experimental development, applied research, basic research, and various types of work in support of this research, including engineering, design, operations research, mathematical analysis, computer programming, data collection, testing, and psychological research.

Eligible expenses include: wages and salaries of employees directly engaged in SR&ED work, overhead expenditures, contract expenditures, materials, and third-party payments subject to certain conditions.

On top of the federal incentives, most provinces have their own programs, some of which provide support as generous as the federal incentive. Combined, in some cases companies can end up paying just over 70 cents on the dollar for valuable R&D activities. If you need help understanding the program and how it works, the knowledgeable team at the Canada Revenue Agency is available for training and information sessions upon request.

International Tax Agreement

One cannot talk about international tax competitiveness without also addressing the recent agreement among 137 members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting, including Canada, on the taxation of large multinational enterprises. The agreement has two pillars. The first pillar focuses on the reallocation of taxing rights over the world’s largest and most profitable corporations. The second pillar would ensure that large multinational enterprises are subject to a minimum effective tax rate of 15% on their profits in every jurisdiction in which they operate.

Countries are now in the implementation phase, with details to be finalized and put into legislation before the target implementation date of 2023. The federal government’s 2022 budget announced that, in light of the progress being made by other countries, the government would move forward with implementing the second pillar of the OECD plan starting at some point in 2023. The 2022 budget also signaled that the federal government is prepared to introduce implementing legislation for the first pillar after the terms are multilaterally agreed.

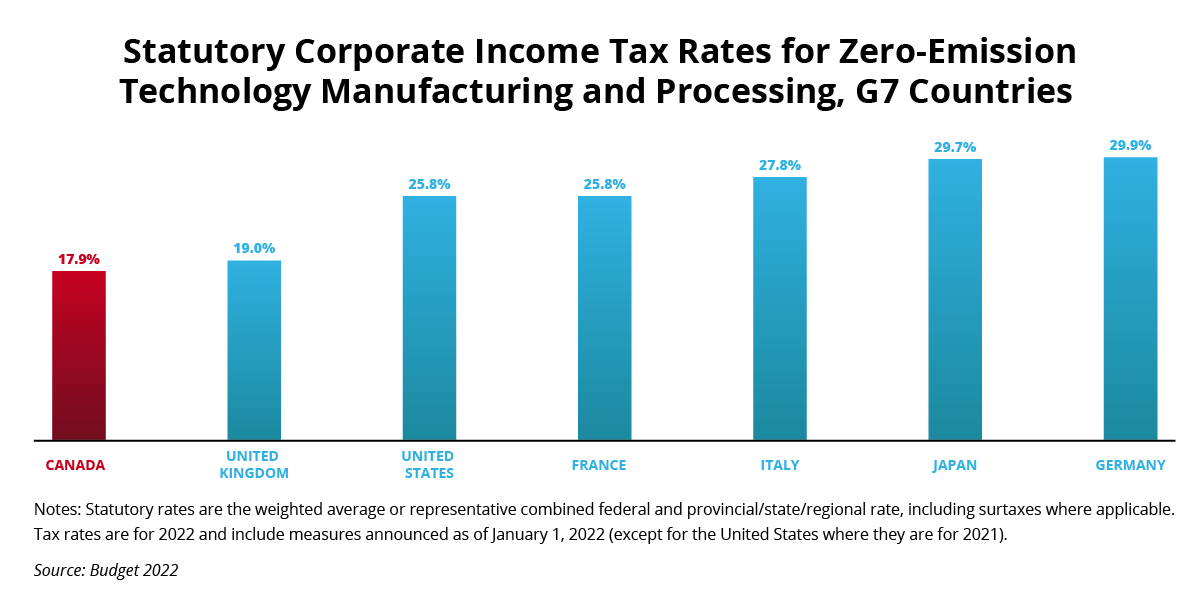

Reduced tax rates for zero-emission technology manufacturers

The federal government’s 2021 budget proposed to reduce – by 50% – the general corporate and small business income tax rates for businesses that manufacture zero-emission technologies for taxation years that begin after 2021. This temporary measure would give Canada the lowest combined federal-provincial-territorial average statutory tax rate in the G7 for this type of activity. This makes Canada an attractive destination for business investment in the clean technology sector – a sector that is getting larger and more valuable every day.

Text version

Statutory Corporate Income Tax Rates for Zero-Emission Technology Manufacturing and Processing, G7 Countries

| Canada | 17.9% |

|---|---|

| United Kingdom | 19.0% |

| United States | 25.8% |

| France | 25.8% |

| Italy | 27.8% |

| Japan | 29.7% |

| Germany | 29.9% |

Notes: Statutory rates are the weighted average or representative combined federal and provincial/state/regional rate, including surtaxes where applicable. Tax rates are for 2022 and include measures announced as of January 1, 2022 (except for the United States where they are for 2021).

Source: Budget 2022

Tax credits for clean technologies

To further assist the country in reaching its net-zero emissions goals, the federal government’s 2022 budget proposed a new tax credit of up to 30% for investments in net-zero technologies, battery storage solutions, and clean hydrogen. Additional details on the latter credit will be released later this year in the fall economic and fiscal update.

At the end of the day, companies choose to locate in Canada for a multitude of factors. The cost of doing business and the country’s tax rate are but two of the many variables that are considered. Canada’s favourable tax system that rewards capital improvements, investments in clean energy generation, and research and development provides further incentive for companies that are prepared to innovate and grow.

Contact us to learn more about all the other reasons companies choose Canada.