Canada's FDI numbers for Q2 and the economic effects of COVID-19

Statistics Canada today released its Foreign Direct Investment (FDI) report for the second quarter (Q2) of 2020. FDI Inflow for the period is $10.8B CAD.

For comparison, in 2019, Q2 results were $20.3B, which reflects a decrease of 46.9% in Q2 of 2020. Compared to Q1 2020, the decrease in Q2 is 13.8%.

How will COVID-19 continue to affect investment in Canada?

It is important to note that the negative effects of COVID-19 on FDI had not been felt significantly in Canada during the January-February-March Q1 period, which saw a minor increase of 0.5% in FDI inflow compared to Q1 of 2019.

The economic slowdown we are facing created by the COVID-19 pandemic is naturally more pronounced in Q2, as the effects of global economic downturns are reflected in the full three-month period of the April-May-June reporting.

We are, of course, not alone in seeing a decline in FDI. The United Nations Conference on Trade and Development (UNCTAD) projected in June 2020 that FDI flows will decrease by 40% globally in 2020 and decrease a further 5% to 10% during 2021, to the lowest levels in the past 20 years. The Organisation for Economic Co-operation and Development (OECD) has published data that reveals FDI flows are expected to fall by more than 30% “even under the most optimistic scenario.”

In Q2, we are seeing that global investors are still making the kinds of important investments that bring jobs and prosperity to Canada, yet the pandemic has—as widely predicted—had significant impact on the international flow of FDI, including foreign direct investment into Canada.

Specific foreign direct investment activity in Q2

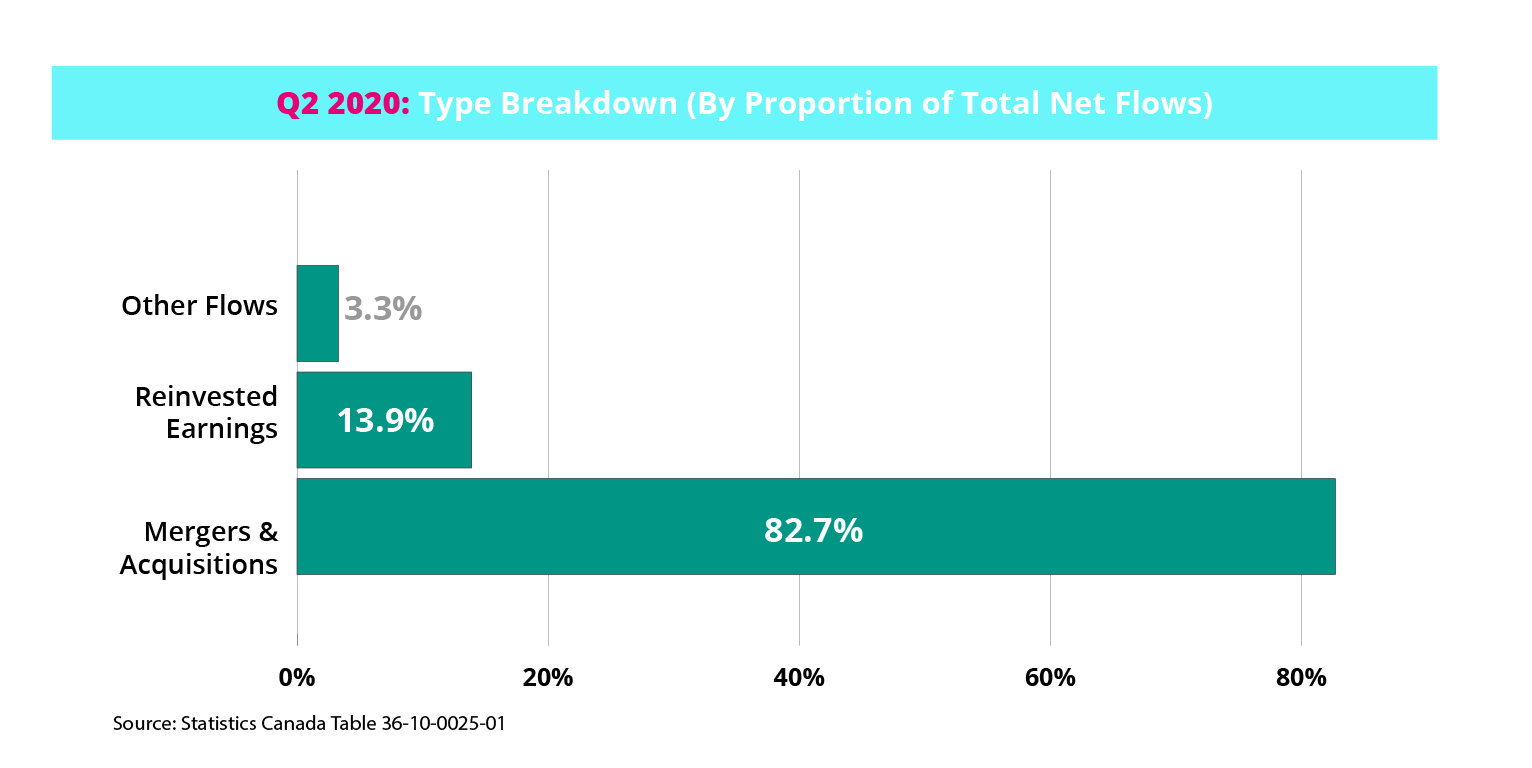

Drilling down deeper and looking at specific types of foreign direct investment in Q2 2020 compared to activity in the same period last year, here’s what we see.

As a proportion of the total net flows for the quarter, Mergers and acquisitions represents, at 82.7%, the largest portion of FDI investment by type. This is followed by Reinvested earnings at 13.9%, and lastly Other flows at 3.3%. Though all of these types saw significant decreases when compared to the dollar amounts of Q2 2019, Mergers and acquisitions saw a 57.4% growth as a proportion of the Q2 2020 net flows (Mergers and acquisitions was 52.6% of net flows in Q2 2019.)

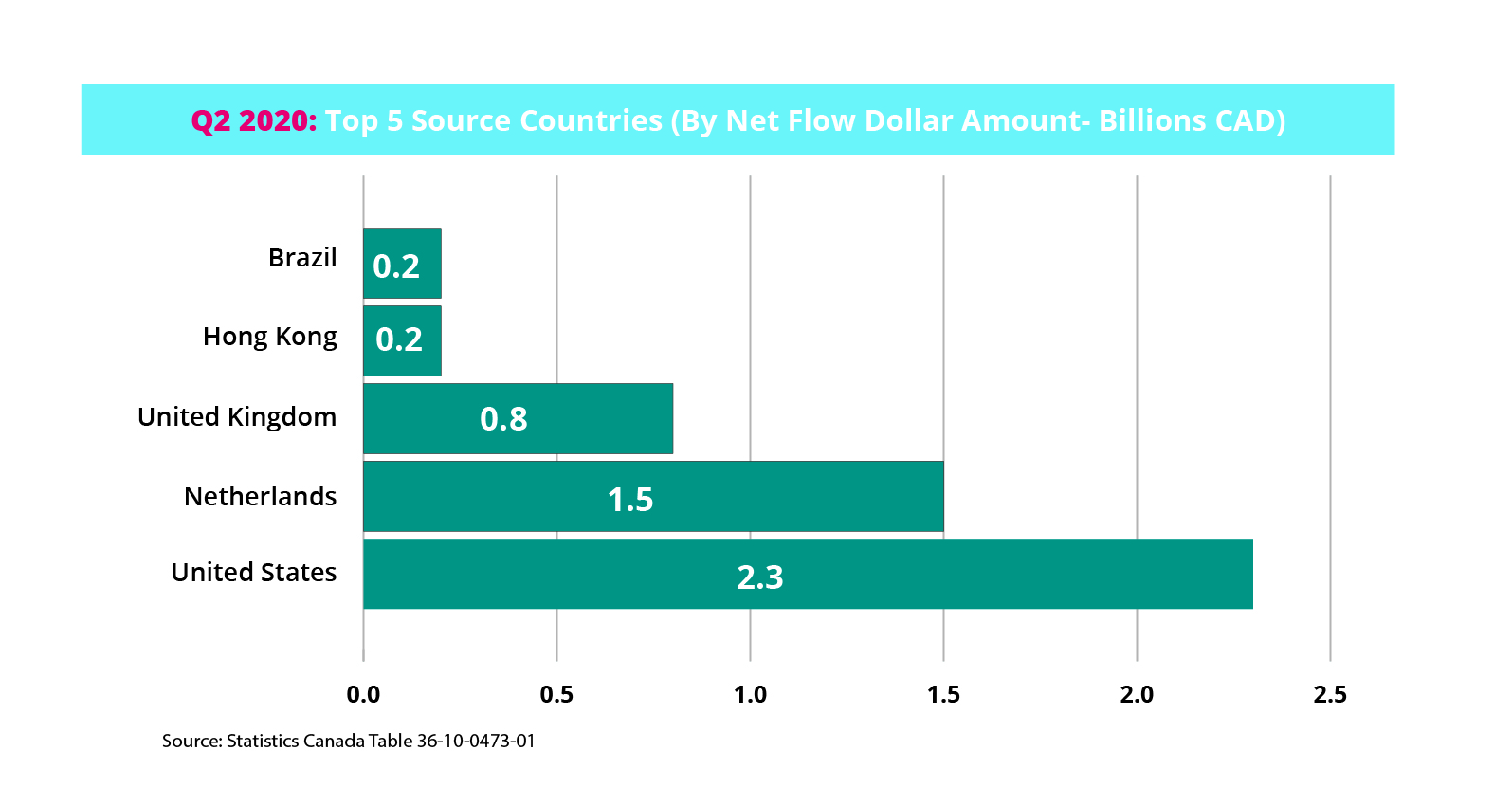

Changing the focus to source countries on an individual country basis, the United States remains the top contributor to FDI with $2.3B in net FDI flows, followed by the Netherlands ($1.5B), the United Kingdom ($0.8B), Hong Kong ($0.2B) and Brazil ($0.2B). At $5.0B in net flows, these five countries comprise 46.3% of total FDI inflows.

(It’s worth noting that Statistics Canada indicates “FDI flows capture the last country the investment was in before entering Canada” in its presentation of source country data.)

When we look at the change in source country share between Q2 2019 and Q2 2020, Germany had the greatest growth—a 92.3% ($0.036B) growth from Q2 2019. The United States (as the top contributor to FDI in Canada) saw a decrease of 86.9% (-$15.4B) compared to Q2 2019.

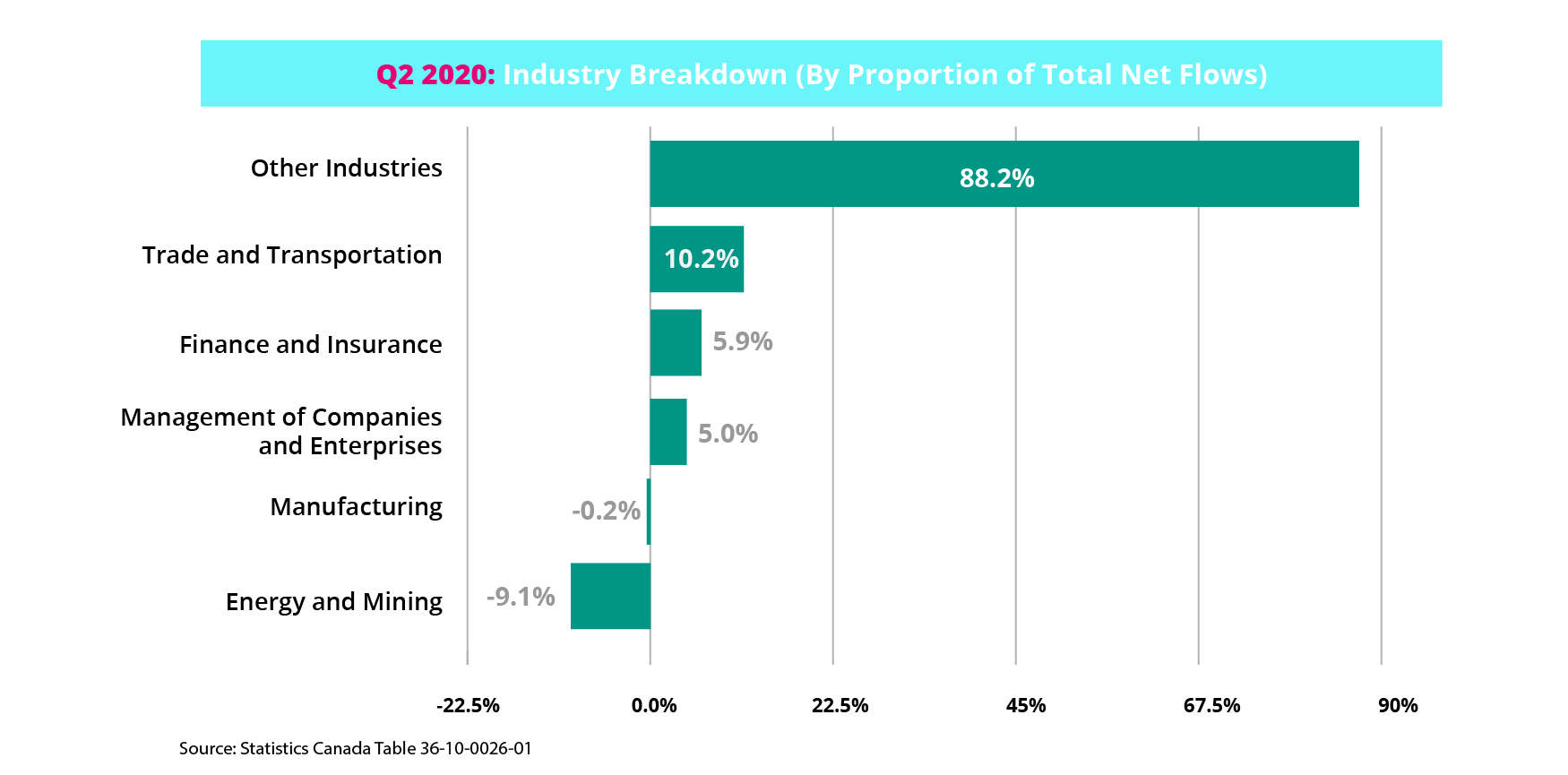

Foreign investment activity by sector

As the Q2 numbers reveal—10.8$B in FDI for the period, representing a 15.5% decrease from average quarterly FDI inflows of $12.8B over the last 10 years—there is still a lot of FDI activity occurring in Canada, even in the midst of this pandemic.

This activity reflects foreign direct investment into Canada taking place all across the country—in all kinds of companies, in all different sectors.

For Q2 2020, the top three industry sectors in which we see global investment in Canada are Other industries—those not individually reported by Statistics Canada—(88.2%), Trade and Transportation (10.2%), and Finance and Insurance (5.9%). Also, notably, Management of Companies and Enterprises contributed 5.0%. Energy and Mining and Manufacturing, however, saw combined flows of -$998.0M in the quarter.

Looking closer at the changes from Q2 2019 to Q2 2020, Other Industries and Management of Companies and Enterprises saw positive increases ($7.4B and $3.5B respectively), while the remaining industries accounted for a $20.5B decrease.

Canada's resilience remains strong

Despite this current reality—we had suggested after the Q1 report was released that things will almost certainly get worse before they get better—we continue to believe Canada is well-positioned for a strong and resilient economic transition that will see global investors choosing the business advantages Canada offers sooner and more widely than many expect.

This confidence we have in Canada’s resilience comes not only from our current preparedness and attractive value proposition, but also from Canada’s past experience.

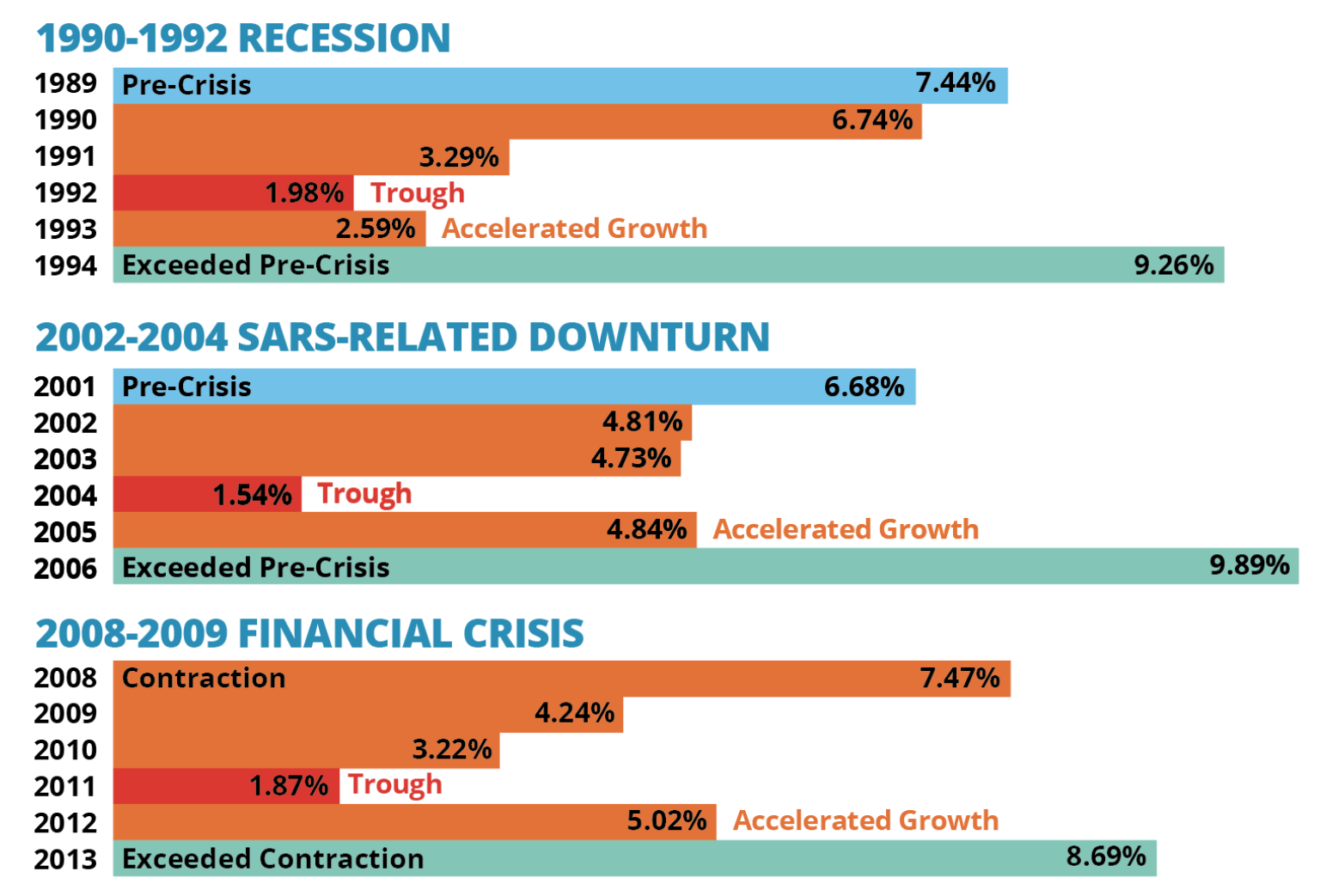

Canada has fared well in FDI growth after major financial crises

It’s worth again acknowledging that FDI to Canada has rebounded quite rapidly after the three most recent crises: the 1990-1992 recession, the 2002-2004 SARS-related economic downturn and the Great Recession of 2008-2009.

In all three crises, FDI stock experienced two consecutive years of accelerated growth after hitting the crisis trough. In two of these three crises, FDI stock returned to pre-crisis growth within two years.

What’s more, following the 2008-2009 financial crisis, Canada also demonstrated remarkable resilience in inbound FDI growth, outperforming OECD growth for four straight years.

It’s this kind of resilience that makes Canada’s current return to economic health not just a matter of hope, but a matter of history. Historical data such as this helps foreign investors make their own cases for choosing Canada as the world enters a new normal filled with continued uncertainty.

(For an in-depth look at Canada’s recovery from previous crises, read the Invest in Canada blog article Canada: A Competitive and Stable Investment during Recession.)

FDI into Canada can help ease the economic pain COVID-19 is inflicting

As we look to emerge from the negative economic effects of COVID-19, foreign direct investment will remain critical to Canada’s recovery. It will remain critical to keeping Canadians employed, helping businesses in Canada continue to grow and innovate, and ensuring communities thrive.

Global businesses need to grow while minimizing risk, which is why foreign investors will continue to choose Canada for both its tremendous opportunities and its stability.

Global investors see a Canada that is resilient, as our economy transitions, in time, from downturn to recovery.

They appreciate Canada’s agility, with programs that quickly and robustly support business.

And, yes, foreign investors see unmatched opportunity—the wide-ranging advantages Canada offers for present and future growth.

As surely as Canada will transition to recovery from this pandemic, foreign direct investment will remain pivotal to the economic future of Canada—and to long-term prosperity for all Canadians.

If you are a foreign investor and interested in what Canada can offer you, learn more at investcanada.ca, then reach out to an Invest in Canada advisor for assistance in establishing or expanding your global business in Canada.