Alberta’s lithium supply chain offers new investment opportunities

Lithium is a highly sought-after resource, as it is a fundamental component for batteries in electric vehicles (EV), electronics and large-scale energy storage. The Canadian province of Alberta has significant lithium resources and is poised to compete in the global market, which is expected to triple by 2025.

Although demand for oil and gas decreased and commodity process dropped due to the COVID-19 pandemic, Alberta is recovering. New industries such as lithium present exciting opportunities for investment and diversification.

Why invest in Alberta?

Alberta is ready to capitalize on the growing demand for lithium. The province’s oil fields hold large deposits of lithium in subsurface brine, which has long been overlooked as industrial waste from oil field operations. Now, technologies known as direct lithium extraction (DLE) are being developed to access Alberta’s lithium-brine potential in many of the same reservoirs as Alberta’s existing oil and gas resources.

Alberta’s large lithium brine deposits are attractive to new mining and mineral processing projects, allowing the province to easily become a strong lithium carbonate producer. Most lithium is produced commercially from either the extraction of lithium-containing salts from underground brine reservoirs or the mining of lithium-containing rock, such as spodumene. Extracted lithium is a critical metal frequently used in batteries for electronics and electric vehicles, as well as in ceramics and glass. Further along the supply chain, there is potential for investment in lithium iron phosphate (LFP) cathodes and battery cell manufacturing to supply the growing EV market.

In addition, Alberta already possesses an abundance of existing geological data and infrastructure to access such reservoirs and has a highly trained workforce that can help realize its lithium production potential.

As set out in the province’s Recovery Plan, Alberta is committed to establishing a new mineral strategy to leverage its’s lithium deposits. In September 2020, the Province announced the establishment of the Mineral Advisory Council to provide strategic advice, guidance and recommendations on a Minerals Strategy and Action Plan for Alberta.

Alberta’s lithium supply chain

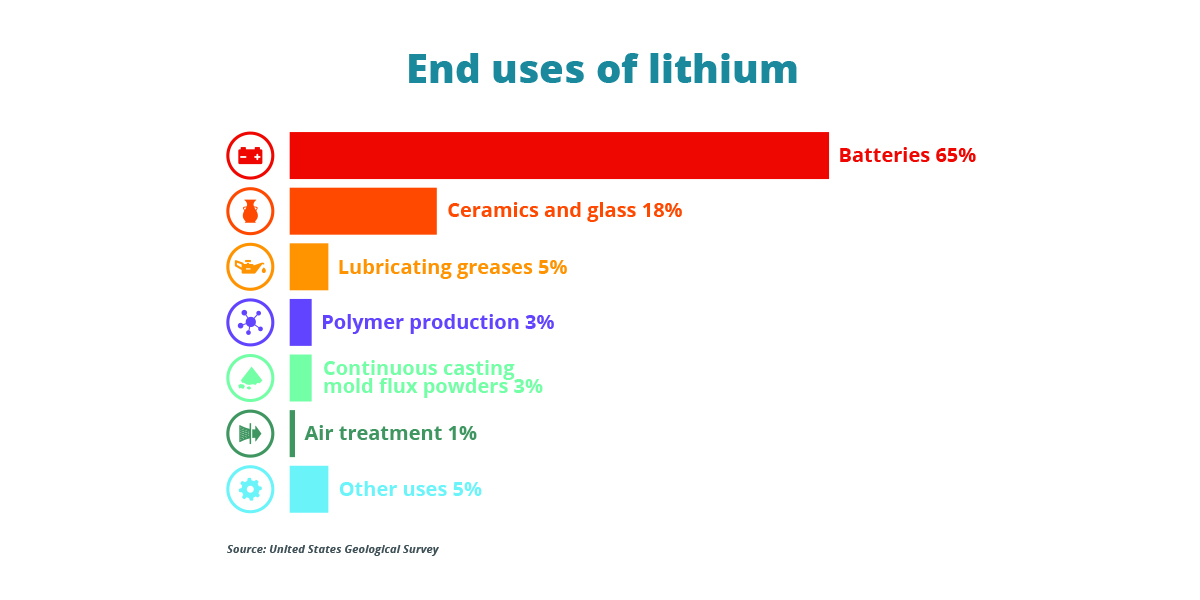

From mining to processing to manufacturing, Alberta has the potential to be an important global supplier of lithium and its end-products, which include batteries, ceramics and glass, lubricating greases, polymer production and more.

HTML version

| Batteries | 65% |

|---|---|

| Ceramics and glass | 18% |

| Lubricating greases | 5% |

| Polymer production | 3% |

| Continuous casting mold flux powders | 3% |

| Air treatment | 1% |

| Other uses | 5% |

Metal extraction

Alberta has a strong value proposition for metal extraction thanks to its abundant reserves of lithium brine. The province holds an estimated 10.6 million tonnes lithium carbonate equivalent in the province. Government studies have shown lithium potential for Cambrian to Triassic formation waters in the province as well as in Devonian formations in the Fox Creek, Leduc, and Swan Hills areas in west-central Alberta.

Mineral processing

Mineral processors primarily seek to locate as close to a mine as possible. In some cases, mining companies are vertically integrated to include a lithium processing plant in close proximity to perform additional value-added functions. Alberta’s lithium brine deposits make it a perfect position to build processing facilities that supply lithium carbonate to the market and with additional investment, it could also provide lithium hydroxide.

Cathode and battery cell manufacturing

Alberta offers advantages for cathode and anode manufacturers, and battery cell manufacturers. The province has some of the best chemical engineering programs in the country and an advanced chemical manufacturing industry, which provide an ample supply of talent and expertise that investors can leverage.

Lithium production underway in Alberta

Canadian and international companies are already recognizing Alberta’s potential for investment in lithium, and several active projects are underway.

- MGX Minerals, Sturgeon Lake: In April 2017, a Technical Report was prepared to examine the recovery of lithium from Sturgeon Lake oilfield brine by solar evaporation, and to evaluate other methods for possible efficiencies with the Purlucid ultrafiltration technology.

- E3 Metals, Clearwater, Rocky and Exshaw: In February 2021, E3 Metals announced the opening of its DLE development and testing facility which included the scale-up and lab prototype campaign in preparation for the field pilot plant.

- Empires Metal Corp, Fox Creek: In February 2021, Empire Metals acquired 100% ownership of the Fox Creek Lithium Project. The company expects lithium demand to rise significantly at an annual growth rate of 19.7% to 2030 and sees their Fox Creek project as being a tremendous opportunity to supply lithium to the world within this period.

These companies recognize that Alberta already possesses the raw materials and know-how to be a leader in the lithium supply chain. The pandemic has accelerated the shift towards shorter, integrated supply chains, and lithium and its end-uses are no exception. As demand continues to grow for EVs, electronics and energy storage, upstream manufacturers are increasingly looking to set up close to suppliers of raw materials. As such, Alberta’s lithium industry presents ample opportunity for new investment.

Interested in learning more or discussing your lithium project? Contact our regional team in Alberta.