2019-20 Departmental results report

Errata

Subsequent to the tabling in Parliament and online publication of IIC’s 2019-20 Departmental Results Report, the following indicator result was revised in the Results Achieved table:

- The 2019-20 Actual Result for indicator ‘Percentage increase in “my opinion of Canada as a prominent global leader for foreign investment” is ‘Not available’.

- For the indicator ‘’Increase in FDI stock from key target marks’’, the target was corrected to 3%, Date to achieve was corrected to December 2019, and the 2019-20 Actual Results was corrected to 15.1%.

Minister's Message

As Canada’s Minister of Small Business, Export Promotion, and International Trade, I am tasked with strengthening the opportunities for Canadian businesses and creating an environment that enhances Canada’s competitive advantages to access global markets and opportunities while strengthening our supply chains and national security. By increasing and diversifying trade and attracting job-creating investment, Canada is positioned to continue to build on its impressive economic growth and enhance the standard of living of all Canadians.

Invest in Canada has worked collaboratively with the Trade Commissioner Service in addition to the provincial, territorial, and municipal governments to accelerate new investment and reinvestment opportunities. This collaboration helped remove potential barriers to foreign direct investment and led to an investment ecosystem with more jobs for Canadians through sustained growth of capital while expanding into innovative sectors.

With its concierge service, Invest in Canada offers direct access to programs and services from all levels of governments that allows foreign investors to enhance their decision-making processes and to investments communities across the country. This was especially important with continued foreign investor interest in Canada’s strong business case during the challenging last weeks of 2019-20 at the onset of the pandemic.

Over the past year, Invest in Canada scaled in size and capability to ensure it met the needs of its clients, and it was well equipped to fulfill its mandate. Its coordination of the Canadian efforts to attract foreign direct investment will continue to be important as the world’s economy changes and we position Canada to continue on its path of innovative growth, translating into positive results for Canadians.

It is my pleasure to present Invest in Canada’s 2019-20 Departmental Results Report, which provides a broad overview of the results achieved based on the plans and priorities outlined for the year.

The Honourable Mary Ng

Minister of Small Business, Export Promotion and Internation Trade

Chair of the Board’s message

Reflecting on 2019-20 brings mixed sentiments as the year brought many successes to the Canadian economy and presented new challenges with the onset of a global pandemic.

On the positive side, we witnessed Canadian cities growing quickly as hubs for innovating technology and industries of the future, and foreign investors realizing the potential that exists in Canadian communities. Canada’s diverse and skilled workforce, global market access, welcoming business climate, and innovative business sectors made the country even more attractive to foreign investors.

Despite the set-back the world faces with COVID-19 disruptions, history and experience point to economic recovery. Canada is resilient and Invest in Canada can help to lead the way for global investments to support economic prosperity and stimulate innovative solutions to recovery.

Canada has a proven track record in sectors such as natural resources and manufacturing, and growing influence in new and exciting sectors, such as artificial intelligence, cleantech, and research and development. These are sectors where Canada’s advantage can set it apart from competitors as businesses around the world look to expand, diversify, and secure their supply chains.

My colleagues and I on the Invest in Canada Board of Directors are committed to supporting Invest in Canada by sharing our experience in international business, regulatory law, private sector equity investments, business development, finance, and operations to help promote, facilitate and accelerate investments into Canada.

Together, the Board is working to ensure that Invest in Canada is well positioned and managed to welcome and support more global companies that choose to expand their businesses in Canada. I am encouraged by the achievements that the organization has seen to date and the positive testimonials that I receive from partners, business leaders and investors across Canada. Invest in Canada’s commitment to success in its two short years of operation gives the Board confidence that Invest in Canada will continue to take a strong leadership role in furthering Canada’s capacity to compete on the global stage.

On behalf of the Board of Directors, I would like to thank Invest in Canada’s management team and the dedicated employees who contribute to improving Canada’s economic conditions through greater global investments. I look forward to continued success for the year ahead.

Mitch Garber

Chair of the Board of Directors

Chief Executive Officer’s Message

Last year was an unprecedented year in many respects. As the 2019-20 fiscal year came to a close, Canada was in a position of success from the perspective of global investments into Canada. At the end of 2019, the country saw an 18.6 percent increase of foreign direct investment inflows over 2018. This steady growth proved to be a promising sign of the strength and attractiveness of Canada as a premier investment destination.

Unfortunately, the latter part of the fiscal year also saw the global economy come to a standstill with the spread of the COVID-19 pandemic. Invest in Canada has done its best to adapt to these challenging conditions and continue to promote investments into Canada as a source of economic growth. Operations have been realigned and staff have adjusted seamlessly to continue their work from home to maintain relationships with clients and partners. Whether participating in virtual industry events or continuing valuable investor engagement remotely, this spirited effort will be necessary to help Canada maintain its presence on the global stage.

At the time of writing, countries around the world continue to be affected by the pandemic, requiring that national governments’ attention and resources be focused on public health and economic recovery. Canada is not in a dissimilar scenario.

The next months and years will be a challenge, but Canada has laid a strong inward global investment foundation to continue to be an attractive investment destination to help the Canadian economy recover. Canadian business hubs around the country have drawn in leading global investors through Canada’s unparalleled talent, impressive global market access, and cost-saving programs and incentives the country has to offer. When combined, these benefits provide Canada with a competitive foreign investment proposition and investors have taken notice.

Throughout 2019-20, Invest in Canada continued to work with federal, provincial, territorial and municipal partners across Canada to promote Canada’s strengths, such as its sound banking system, its strong business environment, and the highly skilled, diverse, and well-educated workforce, that make Canada appealing to global companies.

The last year was also a year of growth for Invest in Canada. The organization grew the team of dedicated professionals to better serve investors and meet our mandate. Invest in Canada collaborated with all levels of government as well as our partners, working particularly closely with the Trade Commissioner Service, to provide a one-stop shop that provides a seamless business expansion service in Canada.

Recognizing that Canada and the world will continue to face challenges in the months and potentially years to come, as the long-term effects of the COVID-19 pandemic continue to unfold, Invest in Canada will continue to collaborate with its federal colleagues to ensure that we are delivering first-class services to ensure that Canada attracts and retains global investment opportunities that will be critical to support Canada’s economic recovery and grow the economy in the future. Amidst uncertainty and challenges, our team at Invest in Canada remains optimistic and poised to support investments into Canada.

I am proud of the work and commitment of Invest in Canada’s employees and Management Team through successful and challenging times, as they continue to support our significant mandate. I look forward to continued success for the year ahead.

Ian McKay

Chief Executive Officer

Results at a Glance and Operating Context

Fiscal year 2019-20 was a year of growth for Invest in Canada (IIC). Last year, IIC increased its staff complement to 56 full-time employees across the organization to support its three program areas: Marketing; Investor Services; and Partnerships and Strategy Development, and its internal services.

In 2019-20, Invest in Canada built on earlier progress to fulfill our mandate according to three guiding principles:

- Promote: presenting Canada as a premier investment destination; delivering polished, research-based, compelling, and consistent messaging; and developing products and marketing campaigns that reflect, increase and improve Canada’s brand abroad.

- Facilitate: supporting Canada’s foreign direct investment proponents, including provincial and territorial government’s, city-based economic development agencies across the country and Global Affairs Canada’s Trade Commissioner Service’s investment officers abroad to connect with prospective global investors; providing critical research and data to partners by collecting, curating and celebrating the positive investment stories across Canada; and

- Accelerate: advancing large-scale and transformative investments; speeding up problem-solving by allocating highly skilled staff resources, research materials, collateral products and introductions to assist clients in arriving at an expedited final investment decision; and accelerating the delivery of world class, operationally excellent service to our clients and successive large scale and transformative investments to Canada.

In 2019-20, IIC expanded its presence into regions across the country to offer decentralized support to be better able to meet the needs of investors looking to capitalize on the unique market benefits that exist across provinces, territories and municipalities and work more closely with partners.

Actual spending in 2019-20 was $26,096,450, which was in line with planned spending and approved authorities of $36,056,589 for 2019-20. The variance between planned spending and actual spending reflects the scale-up of Invest in Canada’s operations and build out of internal capacity following the launch of the organization in March 2018.

In 2019-20, IIC presented its Departmental Results Framework, including core responsibility, foreign direct investment attraction, and associated planned results to the Treasury Board. The core responsibility is to lead the Government of Canada’s FDI attraction efforts by making Canada top-of-mind for foreign investors and providing services in support of investor decisions to expand in Canada.

As IIC’s core responsibility and planned results were not yet approved at the time of the development of the IIC 2019-20 Departmental Plan, tentative core responsibilities (Partnership and Strategy Development, Marketing and Outreach and Investor Services) and planned results were included in the departmental plan. This departmental results report highlights the tentative results and reports out on some of the planned results that were approved in late 2019-20.

Key results achieved in 2019-20:

- 7.7% increase of Canada’s FDI stock, strengthening Canada’s position as a location and destination of choice for global investment;

- 0.33 point increase (representing a 17% increase from 2019 to 2020) in Canada’s score in the global foreign direct investment attractiveness index, highlighting the successful recognition of Canada’s brand as a global leader in investment attraction; and,

- 66 investment leads facilitated with partners (as measured from mid-year to fiscal year end), highlighting global investors’ ability to have simplified access to partners, services and tools to accelerate their investments.

Impact of COVID-19

As the fiscal year came to a close, IIC was impacted by the COVID-19 pandemic in the same way as many other departments. As of March 12, 2020, Invest in Canada moved to a work-from-home state following guidance from public health officials. During the work-from-home state, IIC remained engaged with departments, including the Treasury Board of Canada Secretariat and Public Services and Procurement Canada, to ensure that the organization was up-to-date and coordinated with federal government procedures.

Since moving to remote work, Invest in Canada has continued actively engaging with investors and partners to better understand the impact COVID-19 on expansion plans and their business more broadly. IIC has also been strengthening its research activities to better understand the impact of the pandemic on investments and to provide information and data to partners and clients. In-person events and international conferences have been cancelled or postponed; however, IIC remains fully active and engaged as the organization transitioned from in-person participation at signature events to virtual event participation and online engagement with companies through video conferences.

For more information on Invest in Canada’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core Responsibility

Description: Foreign Direct Investment Attraction

In 2019-20, Invest in Canada (IIC) presented its Departmental Results Framework (DRF), including core responsibility, foreign direct investment attraction, and associated planned results to the Treasury Board. IIC’s core responsibility is to lead the Government of Canada’s foreign direct investment (FDI) attraction efforts by making Canada top-of-mind for foreign investors and providing services in support of investor decisions to expand in Canada.

Results

IIC’s planned results as identified in the 2019-20 Departmental Plan were intended to be tentative results until the organization’s approved departmental results were put in place in late 2019-20. This Departmental Results Report (DRR) reports out on the departmental results and figures put forward in the 2019-20 Departmental Plan, while looking at the efforts made by the organization to fulfill the performance indicators put in place in the approved DRF in late 2019-20.

In support of IIC’s core responsibility and planned results as presented in the 2019-20 Departmental Plan, IIC’s three program areas: Marketing; Investor Services; and Partnerships and Strategy Development worked together with IIC’s Internal Services to achieve results for the organization.

Although targets for many performance indicators will not be available until 2020-21, IIC made significant progress toward its departmental results in support of the core responsibility, illustrated in the table below. In 2019-20, Invest in Canada began working toward its departmental result as identified in the DRF, IIC carried out branding activities to promote FDI in Canada, continued to optimize its brand identity and pursue collaborative promotional opportunities with cross-Canada government partners, and deployed an engagement strategy to pursue thought leadership and promotional opportunities at key international signature events.

In support of the departmental results related to investor interest and recognition of Canada as a location and destination of choice for global investment, IIC carried out an evidence-based market intelligence analysis of the Canadian FDI landscape; developed a forward-looking lead and prospect generation strategy; and grew the existing pipeline of potential and active investors across traditional and new sectors. In developing IIC’s target sectors— agribusiness, advanced manufacturing, clean technologies, digital industries, life sciences, media and entertainment, and natural resources, the organization considered the Innovation Superclusters Initiative and how IIC can foster stronger connections and leverage opportunities and programs designed to support and strengthen industries in Canada.

Additionally, in 2019-20 IIC made progress to optimize investment pursuit and business development models, including reinvestment potential, by ensuring connections to a full range of federal programs. Last year, IIC expanded its presence into regional offices across the country to offer decentralized support to be better able to meet the needs of investors looking to capitalize on the unique market benefits that exist across provinces, territories and municipalities and work more closely with partners.

Developing relationships and scaling up and out across Canada in 2019-20 helped IIC build a strong foundation to provide simplified access to partners, services and tools to help accelerate investments. Going even further, IIC began developing Canada’s Investment Attraction Strategy in 2019-20. The Strategy is a collaborative effort among several federal, provincial, territorial and municipal stakeholders to support the government’s broader growth objectives in innovation, skills development and trade, and assist its sustainable and inclusive economic recovery efforts, while taking into account Canada’s national security interests.

Gender-based analysis plus

Invest in Canada’s long-term plan includes working with non-traditional partners in Canada, where opportunities exist, to leverage investment from abroad. For example, unique investment opportunities and interests may lie with Canada’s Indigenous communities to stimulate development and economic growth through FDI. In support of longer-term goals of diversity and youth empowerment, Invest in Canada will assess the possibility of introducing a program where some positions could be set aside for high performing, recent business school graduates. In addition, these business school graduates will also be targeted for business intelligence positions.

Invest in Canada is part of a broader strategy to transform Canada’s global position. An important part of Canada’s value proposition includes its diversity advantage. In defining target sectors, the organization will consider potential implications of investments on gender and diversity. IIC will work to develop research to better understand the impact of investments on the diverse populations or different types of businesses so that the organization can better work with investors to improve gender parity or diversity goals, while positioning Canada as a top of mind investment destination.

Experimentation

Invest in Canada did not conduct any experiments in 2019-20 as the focus was on executing the mandate as set out. IIC continued to use innovative approaches to deliver services and carry out activities in support of partners and clients, such as digital marketing, regional support across Canada and building key partnerships with industry.

Results achieved

| Departmental results | Performance indicators Footnote * | Target Footnote * | Date to achieve target Footnote * | 2017–18 Actual results Footnote ** | 2018–19 Actual results Footnote ** | 2019–20 Actual results |

|---|---|---|---|---|---|---|

| Foreign investors are aware of Canada as a competitive investment location | Improved score in global foreign direct investment attractiveness index | 0.03 point increase | March 2021 | Not available | Not applicable. | 0.33 point increase |

| Increased awareness/recognition of the Invest in Canada brand | Target will be available in 2020-21 | March 2021 | Not available | Not applicable. | Not available for 2019-20. | |

| Percentage increase in “my opinion of Canada as a prominent global leader for foreign investment” | Target will be available in 2020-21 | March 2021 | Not available | Not applicable. | Not available | |

| Foreign investors demonstrate interest in Canadian investment locations | Increase in FDI stock from key target markets | 3% increase for the 2019 reporting year | December 31, 2019 | Not available | Not applicable. | 15.1% increase from 2018to 2019 (excluding US and Europe) |

| Percentage increase of Canada’s FDI stock | Increase of 4% per year | December 31, 2019 | Not available | Not applicable. | Increase of 7.7% | |

| Canada as an investment destination stays on the short list of investors | Increase in FDI investments from key sectors | Baseline data and a target will be available in 2020 21 | March 2021 | Not available | Not applicable. | Not available for 2019-20. |

| Increased performance in turning initial investments into expanded investments | Number of investors currently receiving Invest in Canada’s reinvestment services | N/A | N/A | Not available | Not applicable. | 148 |

| Number of partners collaborating to access, build and format data sets to be highly available to potential investors | Number of partners collaborating to access, build and format data sets to be highly available to potential investors | 20 | March 2021 | Not available | Not applicable. | Not available for 2019-20. |

| Number of investors/decision makers using the independent Cost Comparative Analysis Tool for FDI decisions | Baseline data and a target will be available in 2020 21 | March 2021 | Not available | Not applicable. | Not available for 2019-20. | |

| Number of investment leads facilitated with partners | 150 | March 2021 | Not available | Not applicable. | 66 (as measured from mid-year to fiscal year end) |

Footnotes

- *

-

As no performance indicators, targets, and dates to achieve targets were indicated in the 2019-20 Departmental Plan, most indicators presented are from the approved Departmental Results Framework (approved after the tabling of the 2019-20 Departmental Plan).

- **

-

Note: Actual results are not available for fiscal years 2017-18 and 2018-19 as Invest in Canada only became operational on March 12, 2018 and the current departmental results were recently approved.

Budgetary Financial Resources (dollars)

| Tentative Core Responsibility (as presented in the 2019-20 Departmental Plan) | 2019–20 Main Estimates | 2019–20 Planned spending | 2019–20 Total authorities available for use | 2019–20 Actual spending (authorities used) | 2019–20 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|---|

| Marketing and Outreach | $19,835,589 | $19,835,589 | $19,835,589 | $13,133,051 | (6,702,538) |

| Investor Services | $3,321,000 | $3,321,000 | $3,321,000 | 2,066,276 | (1,254,724) |

| Partnership and Strategy Development | $6,438,000 | $6,438,000 | $6,438,000 | 4,736,356 | (1,701,644) |

| Total | $29,594,589 | $29,594,589 | $29,594,589 | 19,935,683 | (9,658,906) |

Human resources (full-time equivalents)

| Tentative Core Responsibility (as presented in the 2019-20 Departmental Plan) | 2019–20

Planned full-time equivalents |

2019–20

Actual full-time equivalents |

2019–20 Difference

(Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|---|

| Marketing and Outreach | 14 | 12 | (2) |

| Investor Services | 28 | 24 | (4) |

| Partnership and Strategy Development | 15 | 13 | (2) |

| Total | 57 | 49 | (8) |

Financial, human resources and performance information for Invest in Canada’s Program Inventory is available in GC InfoBasei.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are:

- Acquisition Management Services

- Communication Services

- Financial Management Services

- Human Resources Management Services

- Information Management Services

- Information Technology Services

- Legal Services

- Material Management Services

- Management and Oversight Services

- Real Property Management Services

Budgetary financial resources (dollars)

| 2019–20 Main Estimates | 2019–20 Planned spending | 2019–20 Total authorities available for use | 2019–20 Actual spending (authorities used) | 2019–20 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| $6,462,000 | $6,462,000 | 6,462,000 | 6,160,767 | (301,233) |

Human resources (full-time equivalents)

| 2019–20 Planned full-time equivalents | 2019–20 Actual full-time equivalents | 2019–20 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 10 | 7 | (3) |

Analysis of trends in spending and human resources

Actual expenditures

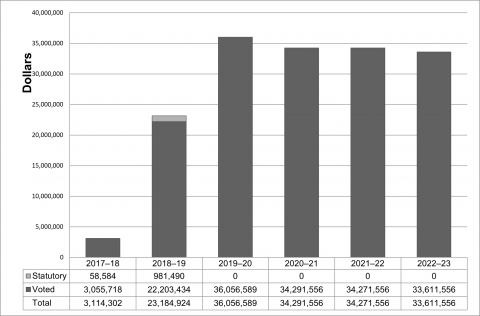

Departmental spending trend graph

The following graph presents planned (voted and statutory spending) over time.

Text Version

| Fiscal Year | Total | Voted | Statutory |

|---|---|---|---|

| 2017-18 | 3,114,302 | 3,055,718 | 58,584 |

| 2018-19 | 23,184,924 | 22,203,434 | 981,490 |

| 2019-20 | 36,056,589 | 36,056,589 | 0 |

| 2020-21 | 34,291,556 | 34,291,556 | 0 |

| 2021-22 | 34,271,556 | 34,271,556 | 0 |

| 2022-23 | 33,611,556 | 33,611,556 | 0 |

Invest in Canada’s funding profile has matched the maturation of the organization. When fully operational, IIC’s funding will stabilize. The organization is responsible for all employee benefits and pension contributions annually.

Budgetary performance summary for Core Responsibilities and Internal Services (dollars)

| Core responsibilities and Internal Services | 2019–20 Main Estimates | 2019–20 Planned spending | 2020–21 Planned spending | 2021–22 Planned spending | 2019–20 Total authorities available for use | 2017–18 Actual spending (authorities used) | 2018–19 Actual spending (authorities used) | 2019–20 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Partnership and Strategy Development Footnote * | NA | $6,438,000 | NA | NA | 6,438,000 | 425,000 | 726,406 | 4,736,356 |

| Marketing and Outreach Footnote * | NA | $19,835,589 | NA | NA | 19,835,589 | 677,000 | 3,219,173 | 13,133,051 |

| Investor Services Footnote * | NA | $3,321,000 | NA | NA | 3,321,000 | 27,000 | 939,388 | 2,066,276 |

| Foreign Direct Investment Attraction Footnote ** | $29,594,589 | NA | $27,433,245 | $27,417,245 | NA | NA | NA | NA |

| Subtotal | $29,594,589 | $29,594,589 | $27,433,245 | $27,417,245 | 29,594,589 | 1,129,000 | 4,884,967 | 19,935,683 |

| Internal Services | $6,462,000 | $6,462,000 | $6,858,311 | $6,854,311 | 6,462,000 | 903,683 | 5,833,968 | 6,160,767 |

| Total | 36,056,589 | 36,056,589 | 34,291,556 | 34,271,556 | 36,056,589 | 2,032,683 | 10,718,935 | 26,096,450 |

Footnotes

- *

-

Tentative core responsibilities as presented in 2019-20 Departmental Plan for fiscal year 2019-20.

- **

-

Revised core responsibility as presented and approved in the Departmental Results Framework for 2020-21 and onward.

Actual Human Resources

Human resources summary for core responsibilities and Internal Services

| Core Responsibilities and Internal Services | 2017–18 Actual full-time equivalents | 2018–19 Actual full-time equivalents | 2019–20 Planned full-time equivalents | 2019–20 Actual full-time equivalents | 2020–21 Planned full-time equivalents | 2021–22 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Partnership and Strategy Development | NA | NA | 15 | 13 | NA | NA |

| Marketing and Outreach | NA | NA | 14 | 12 | NA | NA |

| Investor Services Footnote * | NA | NA | 28 | 24 | NA | NA |

| Foreign Direct Investment Attraction Footnote ** | 0.75 | 29 | NA | NA | 57 | 57 |

| Subtotal | 0.75 | 29 | 57 | 49 | 57 | 57 |

| Internal Services | 0.25 | 7 | 10 | 7 | 10 | 10 |

| Total | 1.0 | 36 | 67 | 56 | 67 | 67 |

Footnotes

- *

-

Tentative core responsibilities as presented in 2019-20 Departmental Plan for fiscal year 2019-20.

- **

-

Revised core responsibility as presented and approved in the Departmental Results Framework for 2020-21 and onward.

Expenditures by vote

For information on Invest in Canada’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2019–2020ii.

Government of Canada spending and activities

Information on the alignment of Invest in Canada’s spending with the Government of Canada’s spending and activities is available in GC InfoBaseiii.

Financial statements and financial statements highlights

Financial statements

Invest in Canada’s financial statements (unaudited) for the year ended March 31, 2020, are available on the departmental website.

Financial statements highlights

Condensed Statement of Operations (unaudited) for the year ended March 31, 2020 (dollars)

| Financial information | 2019–20 Planned results | 2019–20 Actual results | 2018–19 Actual results | Difference (2019–20 Actual results minus 2019–20 Planned results) | Difference (2019–20 Actual results minus 2018–19 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 35,423,000 | 22,659,000 | 8,935,000 | 12,764,000 | 13,724,000 |

| Total revenues | 0 | 0 | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | 35,423,000 | 22,659,000 | 8,935,000 | 12,764,000 | 13,724,000 |

Condensed Statement of Financial Position (unaudited) as of March 31, 2020 (dollars)

| Financial information | 2019–20 | 2018–19 | Difference (2019-20 minus 2018-19) |

|---|---|---|---|

| Total net liabilities | 2,620,000 | 2,491,000 | 129,000 |

| Total net financial assets | 2,456,000 | 2,433,000 | 23,000 |

| Departmental net debt | 164,000 | 58,000 | 106,000 |

| Total non-financial assets | 5,774,000 | 1,831,000 | 3,943,000 |

| Departmental net financial position | 5,610,000 | 1,773,000 | 3,837,000 |

Additional information

Organizational profile

Appropriate minister[s]: The Honourable Mary Ng, P.C., M.P.

Institutional head: Ian McKay

Ministerial portfolio: International Trade

Enabling instrument[s]: Invest in Canada Act

Year of incorporation / commencement: 2018

Other:

Invest in Canada is headquartered in Ottawa and is a departmental corporation, overseen by a board of directors (the board) accountable to the Minister of Small Business, Export Promotion and International Trade. The board is composed of eleven (11) part-time directors, including a Chairperson, Vice-Chairperson, and an ex-officio director, the Deputy Minister of the designated Minister. Apart from the Deputy Minister, all positions are appointed by Order-in-Council to hold office for terms not exceeding three years and are eligible for reappointment in the same or another capacity. A complete list of current board appointees is available on Invest in Canada’s website.

The board supervises and manages Invest in Canada’s business and affairs and advises the Minister and the Chief Executive Officer on matters relating to the organization’s mandate. The Chief Executive Officer is responsible for Invest in Canada’s day-to-day operation.

Invest in Canada’s enabling legislation provides the framework and powers of the organization. It also provides Invest in Canada authority over matters relating to human resources management, contracting, communications, travel and hospitality and other general administrative functions.

Invest in Canada works globally, in partnership with Global Affairs Canada and its Trade Commissioner Service, other federal departments, and provincial and municipal investment attraction offices, to promote Canada as a destination for foreign direct investment.

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on Invest in Canada’s website.

Reporting framework

Invest in Canada’s Departmental Results Framework and Program Inventory of record for 2019–20 are shown below.

Supporting information on the Program Inventory

Financial, human resources and performance information for Invest in Canada’s Program Inventory is available in GC InfoBaseiv.

Supplementary information tables

The following supplementary information tables are available on Invest in Canada’s website:

- Departmental Sustainable Development Strategy

- Details on transfer payment programs of $5 million or more

- Gender-based analysis plus

- Horizontal initiatives

- Status report on transformational and major Crown projects

- Up-front multi-year funding

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expendituresv. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Invest in Canada

160 Elgin Street, Suite 1802

Ottawa, Ontario K2P 2P7

Email: [email protected]

http://www.investcanada.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a three-year period. Departmental Plans are tabled in Parliament each spring.

- Departmental Priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- Departmental Result (résultat ministériel)

- A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- Departmental Result Indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

- Departmental Results Framework (cadre ministériel des résultats)

- Consists of the department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on an appropriated department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- experimentation (expérimentation)

- The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

- An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2019–20 Departmental Results Report, those high-level themes outlining the government’s agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non-budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

- A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.