2021-2022 Departmental results report

Table of Contents

- From the Minister

- From the Chair of the Board of Directors

- From the Chief Executive Officer

- Results at a glance

- Results: what we achieved

- Spending and human resources

- Corporate Information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

From the Minister

As Minister of International Trade, Export Promotion, Small Business and Economic Development, I am honoured to continue to serve Canadians as we work to strengthen our economy, grow our businesses here at home, and around the world.

While Canadians and businesses have faced a tough few years, Canada has shown that it has the strength and skill to navigate toward a resilient and inclusive recovery – a diverse and skilled workforce, global market access, welcoming business climate, high quality of life, immigration policies, and innovative spirit.

Invest in Canada had its most impactful year on record, directly facilitating billions of dollars in investment, including Canada’s largest ever investment in the automotive sector.

To ensure Canada’s long-term success, it is vital to help our businesses start up, scale up and access new international markets. Global businesses help keep Canadian industries innovative and competitive through investment, reinvestment, and mergers and acquisitions. Foreign direct investment creates global connections that open new markets and opportunities for Canadian goods and services. Invest in Canada plays a key role in these efforts.

Last year, Invest in Canada continued to work closely with the Trade Commissioner Service and partners across all levels of government to lead global companies toward impactful, future-looking opportunities that complement Canadian knowledge to ensure long-term, sustainable growth.

It is my pleasure to present the Invest in Canada 2021–22 Departmental Results Report. This document outlines how the organization continued to strengthen the Canada brand, grow Canada’s economy, and support the government’s trade diversification strategy during another year of uncertainty in the global business landscape.

The Honourable Mary Ng

Minister of International Trade, Export Promotion, Small Business and Economic Development

From the Chair of the Board of Directors

Following intense pressure during the initial stages of the COVID-19 pandemic, the outlook for Canadian economic recovery shifted toward promise and optimism in 2021. As global business leaders resumed normal activities and put international expansion plans into action, they turned to Canada, bringing new opportunities and diverse sources of investment. In 2021, global companies invested $75.5 billion in Canada, bringing foreign direct investment (FDI) to a 15-year high.

Most investments came from global companies already operating in Canada. This proves that once these companies choose Canada, they continue to reinvest over the long term, recognizing that Canada has the right conditions for businesses to thrive and grow.

Canada benefits from an integrated network of partners across all levels of government that work closely with the private sector to identify the best to invest in our country. This ongoing collaboration between government and businesses will drive the country’s post-pandemic planning and ensure sustainable growth. Within this network, Invest in Canada continues to play a pivotal role, building partnerships to attract impactful investments to Canadian communities.

Invest in Canada is supported by an experienced private sector Board of Directors that includes executives, entrepreneurs, policy leaders and financial sector leaders. Together, they understand the importance of agility and adaptability when seeking opportunities that generate economic growth in a complex and unpredictable market context.

I would like to thank my Board colleagues for the collaboration, perceptive leadership, sound governance and prudent financial stewardship they have demonstrated over the years to ensure Invest in Canada continues to deliver on its mandate and generate investment opportunities that will benefit all Canadians.

On behalf of the Board of Directors, I extend my sincere gratitude to Minister Ng for her ongoing support to Invest in Canada. I would also like to thank the senior management team for their commitment to delivering results, to interim Chief Executive Officer Katie Curran for her effective leadership of the organization, and to each of the talented employees for their dedication to advancing Canada’s presence in the global arena.

It has been a privilege to serve as Chair of the Board for Invest in Canada. I see exciting new investment opportunities on the horizon for Canada and trust that Invest in Canada will continue to contribute to our country’s excellence.

Mitch Garber

Chair of the Board of Directors

From the Chief Executive Officer

The past year brought more transition, as governments and businesses continued to adapt to the changing landscape caused by the COVID 19 pandemic. What we witnessed, however, was a marked shift toward economic recovery.

Invest in Canada understands the role that foreign direct investment plays in supporting economic prosperity and stimulating innovation in Canada. We continue to work with our economic development partners across the country to identify a stable pipeline of investments in key sectors and attract the most committed global companies to invest in Canada for the long term.

In 2021, Invest in Canada leveraged data and research to target our marketing efforts and deliver effective, relevant messaging and promotional campaigns, that showcase Canada’s global brand and investment advantage. We directly supported numerous investment wins into Canada from the Americas, Europe and Asia towards various sectors— from advanced manufacturing to agri-food, mining, life sciences and technology. These investments were well dispersed throughout Canada.

While Invest in Canada continued to facilitate and promote new investments into a variety of sectors in 2021, we worked in-step with our partners to focus on strategic sectors for investment attraction aligned with the Government of Canada’s priorities: EV battery supply chain and hydrogen. Invest in Canada helped land investments to build Canada’s first large-scale, domestic EV battery manufacturing facility and the world’s first net-zero carbon emissions ethylene plant.

Over the planning period, our team continued to be resilient, adapting to shifting circumstances of the global pandemic. COVID-19 prompted us to work smarter and leverage tools and technology to continue to fulfill our mandate. Whether we met virtually or in-person, we remained focused on promoting Canada’s investment benefits. We supported investment decisions as pandemic restrictions eased and global businesses began to reposition their prospective projects for global expansions.

I would like to thank Minister Ng for her leadership and support and our Board of Directors for their guidance and confidence. I continue to be impressed by our talented team who met and surpassed every challenge over the past year. It has been a tremendous privilege to guide Invest in Canada’s strategic objectives as interim CEO.

Katie Curran

Interim Chief Executive Officer

Results at a glance

The COVID-19 pandemic had profound impacts on the global economy, with many aspects of global investments slowing down during the economic downturn caused by the pandemic. During 2021-22, Invest in Canada continued to promote Canada as a foreign direct investment destination from a virtual state, leveraging online platforms to meet with investors, collaborate and share information with stakeholders and expand awareness through virtual signature events and targeted marketing and promotional channels that amplified Canada’s unique value proposition to strategic global audiences.

Despite challenges posed by the pandemic, Invest in Canada remained nimble throughout the year. The organization has built up its internal capacity to deliver on its priorities and planned results through a program inventory of three areas: Marketing; Investor Services; and Data Partnerships and Pan-Canadian Collaboration. As captured in the 2021-2022 Departmental Plan, the organization’s activities were designed to meet the three target results. The following provides a brief overview of Invest in Canada’s achievements in 2021-22:

Canada’s brand is seen as a global leader in investment attraction

- Launched several media partnerships to promote Canada as an investment destination in target sectors and countries.

- Presented compelling content, such as editorial reports and sector-specific series, in notable global media publications in target markets.

- Launched successful integrated advertising campaigns, an approach that raises awareness across diverse media platforms, that ran in several target markets in support of the Government of Canada’s trade diversification strategy.

- Produced Invest in Canada’s second report on foreign direct investment in Canada, which included video spotlights on FDI success stories in Canadian communities.

Canada is a location and destination of choice for global investment

- Offered support to global investors through 12 key services offered across Canada.

- Provided flexible customized service to global investors through virtual and in-person site visits.

- Facilitated new investments across a broad diversity of sectors including alignment with the Government of Canada’s priorities.

- Collaborated with partners to offer a seamless customer journey to simplify investments decisions to select Canada as their preferred investment destination.

Global investors have simplified access to partners, services and tools to accelerate their investment

- Launched a new information portal, InfoZone, with data and research generated to support investor decision-making.

- Supported partners by providing tools and market intelligence data to support their investment attraction efforts.

- Collaborated with key economic development stakeholders to ensure a coordinated approach when working with global investors and better connect them to the right expert in the right location.

- Coordinated opportunities to share knowledge, products and investment leads with federal partners, including the Trade Commissioner Service Investment Officer network.

For more information on Invest in Canada’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core responsibilities

Foreign Direct Investment Attraction

Description

Invest in Canada’s core responsibility is to lead the Government of Canada’s foreign direct investment (FDI) attraction efforts by making Canada top-of-mind for foreign investors and providing services in support of investor decisions to expand in Canada.

Results

In 2021-22, Invest in Canada’s three program areas—Marketing, Investor Services, and Data Partnerships and Pan-Canadian Collaboration—worked together with the organization’s Internal Services to achieve results in support of the organization’s core responsibility and planned results as presented in the 2021-22 Departmental Plan.

Invest in Canada adapted to a virtual environment and continued to collaborate with stakeholders, engage global investors and promote Canada’s brand to new markets in virtual and innovative ways. Throughout the year, the organization focused on key sectors such as agri-business, advanced manufacturing and clean technologies and defined Canada’s competitive advantages, building a solid case for Canada as an investment destination. In 2021-22, Invest in Canada also explored emerging sectors with growth potential, including electric vehicle batteries and hydrogen, developing sector-specific products, and supporting stakeholders navigating prospective opportunities in these sectors.

In 2021-22, Invest in Canada undertook a review of its Departmental Results Framework to reformulate its results to be geared towards outcomes that more closely reflect the reach and the impact of the organization’s activities, while refining indicators to provide more valid, stable and available data over an extended period of time. These revisions take effect in the 2022-23 departmental plan. For the 2021-22 fiscal year, Invest in Canada will continue to report out on the previously approved Departmental Results Framework and will bridge the information between 2021-22 and 2022-23 indicators where possible in this departmental results report.

Canada’s brand is seen as a global leader in investment attraction

Expanding Canada’s foreign direct investment promotion efforts continues to be a leading priority for Invest in Canada. Last year, Canada remained a top foreign direct investment destination, ranking third on the 2022 A.T. Kearney FDI Confidence Index demonstrating Canada’s continued ability to show strength, safety and stability to business leaders during a period of crisis and disruption caused by the pandemic.

Invest in Canada recognizes that the country’s transition to post-pandemic recovery will require attracting new sources of investment through strategic and focused promotion and marketing efforts. In support of this, the organization continued to raise investor awareness by building on long-term stakeholder and partner relationships to promote Canada as a top investment destination. Over the year, the organization leveraged client testimonials and case studies to craft compelling narratives that resonate with decision-makers. Invest in Canada also continued to deliver targeted advertising that depicts Canada’s strengths and advocates its brand internationally. As pandemic restrictions eased, the organization also returned to supporting in-person signature events and activities, such as contributing to the Canadian Pavilion at Expo 2020 Dubai.

In 2021-22, Invest in Canada launched media partnerships to promote Canada as an investment destination in target sectors and countries and in support of the Government of Canada’s trade diversification strategy. Invest in Canada carried out integrated advertising campaigns focusing on five key markets: the United States, the United Kingdom, France, Japan, South Korea over various parts of the fiscal year, which led to 984 thousand site visits to Invest in Canada’s website. Further, these campaigns along with the organization’s second report on foreign direct investment in Canada, which included video spotlights on FDI success stories in Canadian communities helped to raise awareness and recognition of the Invest in Canada brand.

Over the fiscal year, Invest in Canada recognized a need to update departmental results indicators to better reflect the reach and the impact of the organization’s activities. Measuring Canada’s global foreign direct investment attractiveness index through the A.T. Kearney FDI Confidence Index does not accurately reflect Invest in Canada’s efforts to move the needle on attractiveness. Going forward Invest in Canada will measure target audience individuals exposed to the organization’s promotional activities through content and events, in addition to the number of unique reach of promotional campaigns. Further, Invest in Canada will move toward a Net Promoter Score (NPS) as a globally recognized and proven metric to measure overall perception of brand instead of measuring “Percentage increase in ‘my opinion of Canada as a prominent global leader for foreign investment.’”

Canada is a location and destination of choice for global investment

Last year, global companies invested $75.5 billion in Canada, bringing FDI to a 15-year high. As global business leaders resumed normal activities and put international expansion plans into action, Canada played a key role in their plans. Investments from key sectors rose to 239 announced FDI projects over the 2021-22 fiscal year. Canada’s FDI stock increased 7.8% over the previous year and FDI from key target markets increased by 2.9%.

Over the 2021-22 fiscal year, Invest in Canada served as a hub for investment attraction, leveraging the services and programs of partners across Canada to put forward Canada’s key strengths and value proposition focused around the country’s highly skilled workforce, programs and incentives, welcoming investment climate and innovative spirit. Further, Invest in Canada, along with several federal institutions, began implementing the new federal Foreign Direct Investment Attraction Strategy, which builds on Canada’s strong FDI performance and sets out key actions to make federal partners in the FDI ecosystem even more effective at attracting foreign investors to Canada. Invest in Canada worked closely with federal and regional partners, like the Trade Commissioner Service to facilitate 48 investment wins, representing the potential of $25 billion in project value and approximately 8,900 new jobs across Canada. Of these wins, Invest in Canada supported notable investments in Canada’s first large-scale, domestic EV battery manufacturing facility and in the world’s first net-zero carbon emissions ethylene plant.

Going forward the organization will continue to provide support to partners and initiatives to ensure that investors are investing or expanding in Canada through the support of Invest in Canada services and will measure the number of new investments or expansions supported by the organization and the number of investors receiving Invest in Canada services to demonstrate success toward this result.

Global investors have simplified access to partners, services and tools to accelerate their investment

In 2021-22, Invest in Canada continued to execute a data-driven approach to FDI promotion and attraction efforts, supporting partners with clear and timely information to drive a forward-looking roadmap of the FDI landscape to support investment targeting and decision-making. Over the year, Invest in Canada facilitated 246 investment leads with federal, provincial, territorial and municipal partners.

Business intelligence continued to support FDI into all regions across Canada, including small and rural locations often hardest hit by necessary pandemic restrictions. Invest in Canada coordinated efforts with partners to improve prospective investors’ access to a full suite of services, data tools and information. Last fiscal year, 3,487 investors/decision makers accessed the independent Cost Comparative Analysis Tool and 51 partners collaborated to access, build and format data sets to be highly available to potential investors.

In support of delivering partners and other stakeholders with real-time access to accurate, FDI-focused data, Invest in Canada launched the beta version of the organization’s DataHub in March 2020. The platform provided a small group of select municipal partners with early access to test the platform and provide feedback on how to improve the tool to meet their specific needs. Over the course of the 2020-21 fiscal year, Invest in Canada re-envisioned its partner platform and launched InfoZone in March 2021, which include the DataHub as one tool among many. Invest in Canada continued to implement and update InfoZone throughout the 2021-22 fiscal year, making it a one-stop central interface to allow partners to access data, information, research, and marketing material.

Going forward Invest in Canada will ensure that partners have access to services and tools to support their investment attraction efforts by developing and providing stakeholders across Canada with a number of knowledge products and data through a platform that gives real-time, centralized access to information required for daily interactions with investors.

Gender-based analysis plus

Invest in Canada is continuing to increase its competency related to equity, diversity and inclusion and gender-based analysis plus. Many investors with whom Invest in Canada works understand that gender parity and diversity are important objectives when identifying an investment location. As part of organization’s integrated advertising campaigns and through its content marketing, Canada’s value proposition as a highly educated and diverse workforce is highlighted and brought to the fore through visual representation that showcases diverse ethnicities and gender parity in Canada.

As an employer, Invest in Canada is committed to ensuring jobs within the organization are evaluated based their value and addresses the general undervaluation of women’s work, which contributes to the gender pay gap. Last year, the organization undertook a job description and salary review to establish a universal tool for evaluating the relative worth of jobs and ensure the salary ranges are based on market rates in both the public and private sectors through a benchmarking exercise.

Over the next year, Invest in Canada will complete a pay equity exercise and create a pay equity plan as outlined in the Pay Equity Act. The exercise will compare female and male dominated job classes to determine whether there are pay equity discrepancies. As a result, a pay equity plan will be created to address any pay equity issues.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Invest in Canada continued to support the Federal Sustainable Development Strategy (FSDS) goal of transitioning to a low carbon economy through green procurement. In 2021 22, Invest in Canada used Public Services and Procurement Canada’s consolidated procurement instruments, which include environmental considerations and enables organizations to purchase more environmentally preferable goods and services.

Experimentation

Invest in Canada did not conduct any experiments in 2021-22 as the focus was on executing the mandate as set out. Invest in Canada continued to use innovative approaches to deliver services and carry out activities in support of partners and clients, such as digital marketing, virtual site visits, regional support across Canada and building key partnerships with industry.

Key risks

Like many federal entities, Invest in Canada had to adapt to new dynamics and challenges brought on by the COVID-19 pandemic. Although the risk was beyond the control of the organization, mitigation strategies were put in place to ensure that the organization was able to adapt and deliver on its mandate while complying with COVID 19 related rules and restrictions. Invest in Canada remained fully active and engaged as the organization leveraged online tools to engage with companies through virtual site tours, video conferences and events, as well as by amplifying the organization’s digital presence to expand reach and provide partners with the data they need to land investments in their respective markets. Likewise, as pandemic restrictions began to ease, Invest in Canada was able to adapt its approach to events and site visits to best serve clients and support partners.

Results achieved

The following table shows, for Foreign Direct Investment Attraction, the results achieved, the performance indicators, the targets and the target dates for 2021–22, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

| Canada’s brand is seen as a global leader in investment attraction | Improved score in global foreign direct investment attractiveness index | 0.03 point increase | March 2022 | 0.33 point increase | 0.1 point decrease | 0.03 decrease Footnote 1 |

| Increased awareness/recognition of the Invest in Canada brand | 2 percentage points above average | March 2021 | 34% (6 percentage points above average) | n/a Footnote 2 | n/a Footnote 2 | |

| Percentage increase in "my opinion of Canada as a prominent global leader for foreign investment" | 60-69% | March 2023 | 67.1% Baseline established in 2020 | n/a Footnote 3 | n/a Footnote 3 | |

| Canada is a location and destination of choice for global investment | Percentage increase of Canada’s FDI stock | Increase of 1.3% per year | December 31, 2020 | 7.7% increase from 2018 to 2019. | 2.7% increase from 2019 to 2020. | 7.8 % increase from 2020 to 2021 |

| Increase in FDI stock from key target markets | 2% increase for the 2019 reporting year | December 31, 2020 | 15.1% increase from 2018 to 2019 (excluding US and Europe) | 5.5% decrease from 2019 to 2020 (excluding US and Europe) Footnote 4 | 2.9% increase from 2020 to 2021 (excluding US and Europe) | |

| Increase in FDI investments from key sectors Footnote 5 | Target set in 2021: 170 | March 2021 | 293 announced FDI projects in 2019-2020 FY | 230 announced FDI projects in 2020-21 FY | 239 announced FDI projects in 2021-22 | |

| Global investors have simplified access to partners, services and tools to accelerate their investment | Number of investors/decision makers using the independent Cost Comparative Analysis Tool for FDI decisions | Target of 600 users set in 2021. | March 2022 | Not available | Cost Comparative Analysis Tool launched Feb.11, 2021. Target of 600 users anticipated in 2021-22 period. | 3,487 |

| Number of partners collaborating to access, build and format data sets to be highly available to potential investors | 20 | March 2021 | Not available | 35 federal, provincial, territorial, and municipal organizations | 51 | |

| Number of investment leads facilitated with partners | 150 | March 2021 | 66 (as measured from mid-year to fiscal year end) | 166 | 246 |

Footnotes for table: Results achieved

- 1

-

Due to the global pandemic all countries in the top 10 of the Kearney index saw a decrease in their foreign direct investment attractiveness score in the last two years. Canada maintained its top three ranking in 2022.

- 2

-

Actual result is measured every three years.

- 3

-

Actual result is measured every three years.

- 4

-

As a result of the global pandemic FDI stock significantly declined around the world. More traditional investment countries such as the United States and countries in Europe continued to invest in Canada.

- 5

-

Key Sectors: agribusiness, advanced manufacturing, clean technologies, digital industries, life sciences, media and entertainment, and natural resources.

Financial, human resources and performance information for the Invest in Canada Hub’s Program Inventory is available in GC InfoBasei.

Budgetary financial resources (dollars)

The following table shows, for Foreign Direct Investment Attraction budgetary spending for 2021–22, as well as actual spending for that year.

|

2021–22 Main Estimates |

2021–22 planned spending |

2021–22 total authorities available for use |

2021–22 actual spending |

2021–22 difference |

|---|---|---|---|---|

| $27,417,245 | $27,417,245 | $29,131,823 | $28,972,353 | $1,555,108 |

Financial, human resources and performance information for the Invest in Canada Hub’s Program Inventory is available in GC InfoBaseii.

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

|

2021–22 planned full-time equivalents |

2021–22 actual full-time equivalents |

2021–22 difference |

|---|---|---|

| 57 | 57 | 0 |

Financial, human resources and performance information for the Invest in Canada Hub’s Program Inventory is available in GC InfoBaseiii.

Internal Services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Budgetary financial resources (dollars)

The following table shows, for Internal Services, budgetary spending for 2021–22, as well as spending for that year.

|

2021–22 Main Estimates |

2021–22 planned spending |

2021–22 total authorities available for use |

2021–22 actual spending |

2021–22 difference |

|---|---|---|---|---|

| $6,854,311 | $6,854,311 | $6,854,311 | $5,514,688 | ($1,339,623) |

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to carry out its internal services for 2021–22.

|

2021–22 planned full-time equivalents |

2021–22 actual full-time equivalents |

2021–22 difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 10 | 10 | 0 |

Spending and human resources

Spending

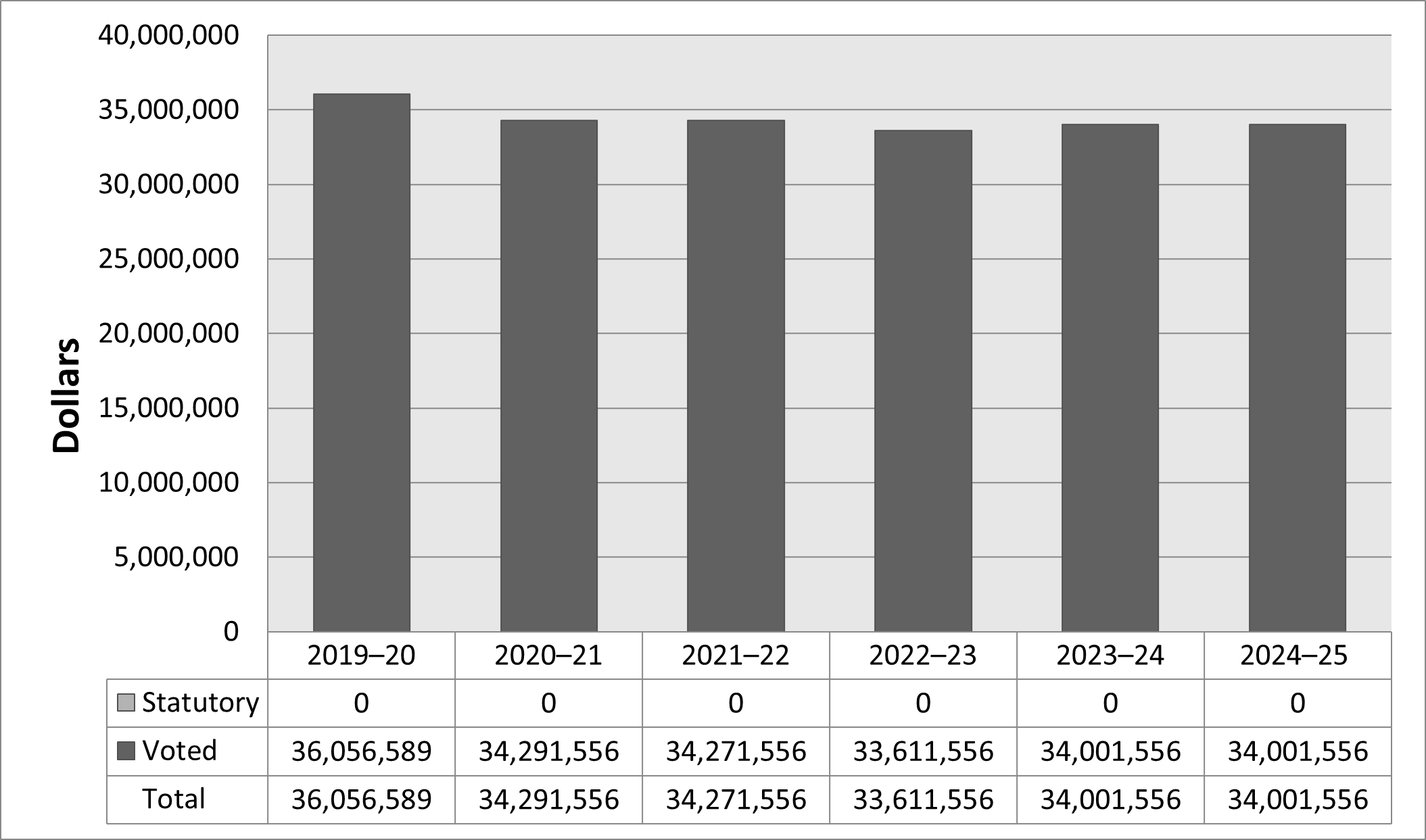

Spending 2019–20 to 2024–25

The following graph presents planned (voted and statutory spending) over time.

Text Version

| Fiscal year | Total | Voted | Statutory |

|---|---|---|---|

| 2019-20 | 36,056,589 | 36,056,589 | 0 |

| 2020-21 | 34,291,556 | 34,291,556 | 0 |

| 2021-22 | 34,271,556 | 34,271,556 | 0 |

| 2022-23 | 33,611,556 | 33,611,556 | 0 |

| 2023-24 | 34,001,556 | 34,001,556 | 0 |

| 2024-25 | 34,001,556 | 34,001,556 | 0 |

Invest in Canada’s funding profile has matched the maturation of the organization. Invest in Canada is responsible for all employee benefits and pension contributions annually.

Budgetary performance summary for core responsibilities and internal services (dollars)

The “Budgetary performance summary for core responsibilities and internal services” table presents the budgetary financial resources allocated for Invest in Canada’s core responsibilities and for internal services.

| Core responsibilities and Internal Services |

2020–21 Main Estimates |

2020–21 planned spending |

2021–22 planned spending |

2022–23 planned spending |

2020–21 total authorities available for use |

2018–19 actual spending (authorities used) | 2019–20 actual spending (authorities used) | 2020–21 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Foreign Direct Investment Attraction | $27,417,245 | $27,417,245 | $26,889,245 | $27,201,245 | $29,131,823 | $19,935,683 | $22,370,508 | $28,972,353 |

| Internal Services | $6,854,311 | $6,854,311 | $6,722,311 | $6,800,311 | $6,854,311 | $6,854,311 | $7,251,599 | $5,514,688 |

| Total | $34,271,556 | $34,271,556 | $33,611,556 | $34,001,556 | $35,986,134 | $26,096,450 | $29,622,107 | $34,487,041 |

Invest in Canada was formally established on March 12, 2018. Spending from 2021-22 to 2024 25 reflects funding for Invest in Canada at a steady state.

Human resources

The “Human resources summary for core responsibilities and internal services” table presents the full-time equivalents (FTEs) allocated to each of Invest in Canada’s core responsibilities and to internal services.

| Core responsibilities and Internal Services | 2019–20 actual full-time equivalents | 2020–21 actual full-time equivalents | 2021–22 planned full-time equivalents | 2021–22 actual full time equivalents | 2022–23 planned full-time equivalents | 2023–24 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Foreign Direct Investment Attraction | 49 | 57 | 57 | 57 | 57 | 57 |

| Internal Services | 7 | 10 | 10 | 10 | 10 | 10 |

| Total | 56 | 67 | 67 | 67 | 67 | 67 |

Expenditures by vote

For information on the Invest in Canada Hub’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2020–2021.iv

Government of Canada spending and activities

Information on the alignment of the Invest in Canada Hub’s spending with the Government of Canada’s spending and activities is available in GC InfoBase.v

Financial statements and financial statements highlights

Financial statements

Invest in Canada’s financial statements (unaudited) for the year ended March 31, 2022, are available on the departmental website.

Financial statement highlights

| Financial information |

2021–22 planned results |

2021–22 actual results |

2020–21 actual results |

Difference (2021–22 actual results minus 2021–22 planned results) |

Difference (2020–21 actual results minus 2020–21 actual results) |

|---|---|---|---|---|---|

| Total expenses | $33,651,000 | $36,300,00 | $32,169,000 | $2,649,000 | $4,131,000 |

| Total revenues | $0 | $0 | $0 | $0 | $0 |

| Net cost of operations before government funding and transfers | $33,651,000 | $36,300,00 | $32,169,000 | $2,649,000 | $4,131,000 |

| Financial information | 2021–22 | 2020–21 | Difference (2021–22 minus 2020–21) |

|---|---|---|---|

| Total net liabilities | $6,238,000 | $3,792,000 | $2,446,000 |

| Total net financial assets | $6,158,000 | $3,612,000 | $2,546,000 |

| Departmental net debt | $80,000 | $180,000 | ($100) |

| Total non-financial assets | $2,407,000 | $3,704,000 | ($1,297,000) |

| Departmental net financial position | $2,327,000 | $3,524,000 | ($1,197,000) |

The 2021–22 planned results information is provided in Invest in Canada’s Future-Oriented Statement of Operations and Notes 2021–22vi.

Corporate Information

Organizational profile

- Appropriate minister[s]:

- The Honourable Mary Ng, P.C., M.P.

- Institutional head:

- Katie Curran

- Ministerial portfolio:

- International Trade

- Enabling instrument[s]:

- Invest in Canada Actvii

- Year of incorporation / commencement:

- 2018

- Other:

-

Invest in Canada is headquartered in Ottawa and is a departmental corporation, overseen by a board of directors (the board) accountable to the Minister of International Trade, Export Promotion, Small Business and Economic Development (The Minister). The board is composed of eleven (11) part-time directors, including a Chairperson, Vice-Chairperson, and an ex-officio director, the Deputy Minister of the designated Minister. Apart from the Deputy Minister, all positions are appointed by Order-in-Council to hold office for terms not exceeding three years and are eligible for reappointment in the same or another capacity. A complete list of current board appointees is available on Invest in Canada’s website.viii

The board supervises and manages Invest in Canada’s business and affairs and advises the Minister and the Chief Executive Officer (CEO) on matters relating to the organization’s mandate. The CEO is responsible for Invest in Canada’s day-to-day operation.

Invest in Canada’s enabling legislation provides the framework and powers of the organization. It also provides Invest in Canada authority over matters relating to human resources management, contracting, communications, travel and hospitality and other general administrative functions.

Invest in Canada works globally, in partnership with Global Affairs Canada and its Trade Commissioner Service, other federal departments, and provincial and municipal investment attraction offices, to promote Canada as a destination for foreign direct investment.

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on the Invest in Canada Hub’s website.ix

Operating context

Information on the operating context is available on the Invest in Canada Hub’s website.xi

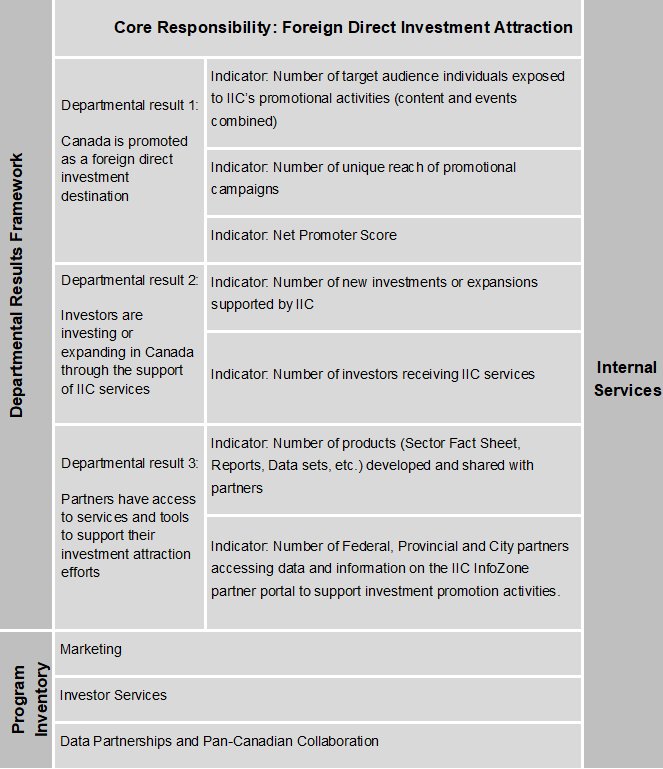

Reporting framework

Invest in Canada’s Departmental Results Framework and Program Inventory of record for 2021-22 are shown below.

Text Version

Departmental Results Framework

- Core Responsibility: Foreign Direct Investment Attraction

- Departmental result 1: Canada’s brand is seen as a global leader in investment attraction

- Indicator: Improved score in global FDI attractiveness index

- Indicator: Increased awareness/recognition of the Invest in Canada brand

- Indicator: Percentage increase in “my opinion of Canada as a prominent global leader for foreign investment”

- Departmental result 2: Canada is a location and destination of choice for global investment

- Indicator: Percentage increase of Canada’s FDI stock

- Indicator: Increase in FDI stock from key target markets

- Indicator: Increase in FDI investments from key sectors

- Departmental result 3: Global investors have simplified access to partners, services and tools to accelerate their investment

- Indicator: Number of investors/decision makers using the independent Cost Comparative Analysis Tool for FDI decisions

- Indicator: Number of partners collaborating to access, build and format data sets to be highly available to potential investors

- Indicator: Number of investment leads facilitated with partners

- Program Inventory

- Marketing

- Investor Services

- Data Partnerships and Pan-Canadian Collaboration

- Internal Services

Supporting information on the program inventory

Financial, human resources and performance information for Invest in Canada’s Program Inventory is available in GC InfoBase.xi

Supplementary information tables

The following supplementary information tables are available on Invest in Canada’s website:

- Departmental Sustainable Development Strategy/Reporting on Green Procurement

- Gender-based analysis plus

- United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures.xii This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address: 160 Elgin Street, 18th Floor Ottawa ON K2P 2P7

Email: [email protected]

Website(s): www.investcanada.ca

Appendix: definitions

- appropriation (crédit)

-

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

-

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

-

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

-

A report on the plans and expected performance of an appropriated department over a 3 year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

-

A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

-

A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

-

A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

-

A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

-

A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- experimentation (expérimentation)

-

The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

- full time equivalent (équivalent temps plein)

-

A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

-

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

-

For the purpose of the 2020–21 Departmental Results Report, those high-level themes outlining the government’s agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

- horizontal initiative (initiative horizontale)

-

An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non budgetary expenditures (dépenses non budgétaires)

-

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

-

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

-

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

-

The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

-

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

-

Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

-

Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

-

A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

-

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

-

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

-

Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.