2022-2023 Departmental plan

2561-6188

Table of Contents

- From the Minister

- From the Chair of the Board

- From the Chief Executive Officer

- Plans at a glance

-

Core responsibilities: planned results and resources, and key risks

-

Foreign Direct Investment Attraction

- Description

- Planning highlights

- Gender-based analysis plus

- United Nations’ (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

- Experimentation

- Key risk(s)

- Planned results for Foreign Direct Investment Attraction

- Planned budgetary spending for Foreign Direct Investment Attraction

- Planned human resources for Foreign Direct Investment Attraction

-

Foreign Direct Investment Attraction

- Internal Services: planned results

- Planned spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

From the Minister

As Minister of International Trade, Export Promotion, Small Business and Economic Development, I am honoured to continue to serve Canadians as we work collectively to chart our path toward long-term, post-pandemic recovery.

Though these past two years have been exceptionally challenging, Canada is in a solid position to build a more resilient, inclusive and stronger country every person living in Canada can be proud of.

To support this transition, the Prime Minister has entrusted me with the vital responsibility of strengthening and securing critical supply chains by working with my Ministerial colleagues to advance Canada’s export diversification strategy.

Canada has abundant skilled talent, a sought-after supply of diverse, low-carbon natural resources, a thriving innovation ecosystem and a robust environmental policy agenda. These offerings are part of the Canadian advantage. They are also foundational to our whole-of-government approach to creating good, clean jobs for Canadians through strategic investments that address our urgent domestic and global climate change challenges on the path to recovery.

Canadian small businesses have an essential role to play in our economic diversification. Ensuring they have the support they need to recover and thrive is an objective near and dear to me.

To set the Canadian business landscape up for long-term success, expanding opportunities for economic diversification through a strategic foreign direct investment attraction strategy is paramount. Led by Invest in Canada and working in close collaboration with the Trade Commissioner Service, all levels of government and the private sector, our government will ensure global investors can easily navigate Canada’s business landscape.

Canada has proven itself a leader in clean technology. Our small and medium-sized enterprises are developing new and innovative decarbonization technologies – this is an encouraging opportunity for accelerated investments and access to new global markets.

Through a focused promotion strategy with a clear, compelling and distinctly Canadian value proposition, Invest in Canada will continue its important work of attracting diversified foreign direct investment, which in turn will help to fill in supply chain gaps by combining Canadian know-how and innovation with expertise drawn from our global peers.

I look forward to continuing my work to support Invest in Canada to ensure it can deliver on its economically important mandate and maximize our return on investment for Canadian taxpayers.

I am pleased to present Invest in Canada’s 2022-23 Departmental Plan, which outlines its strategy to meet its priorities and results over the coming year.

The Honourable Mary Ng

Minister of International Trade, Export Promotion, Small Business and Economic Development

From the Chair of the Board

There are steady signs of optimism that the global economy is rebounding from the pressures of the early days of the pandemic, which made plain the importance of ensuring a stable and predictable domestic supply chain for the critical goods and services Canadians rely on every day.

According to the OECD, foreign direct investment (FDI) flows are increasing and continue to exceed pre-pandemic levels.

This presents a considerable opportunity for Canadian-made products and talent to attract new and diverse sources of FDI to grow a competitive marketplace, where global businesses and Canadian companies can thrive and scale their offerings here at home and abroad.

Canada benefits from a pro-competition landscape backed by a substantial FDI attraction strategy that ensures government bodies and the private sector work collaboratively to identify and promote Canada’s unique value offerings for global investment.

This collaboration between government and private sector businesses is essential to our collective socio-economic success as we transition to post-pandemic planning and growth. This is where Invest in Canada continues to play a pivotal role as a coordinator of government and private sector efforts.

The organization is supported by the innovative thinking and on-the-ground expertise of its private sector Board composed of experienced executives, entrepreneurs, policy leaders and venture capitalists. We have direct knowledge of the trials and opportunities of a volatile market context and understand the importance of remaining agile and adaptable while maintaining a keen ability to identify business opportunities that generate economic growth.

Each board member brings a unique perspective and understanding of foreign investors’ challenges. We remain convinced that no country offers a better combination of winning conditions for foreign investors than Canada, and we intend to continue to spread that message and pursue investment. Together, we offer practical insight and a growth mindset to Invest in Canada’s strategic direction and oversight.

Our Board remains committed to ensuring Invest in Canada is well placed to maximize the potential of its growing national and international network of public and private sector partners. This network is working collaboratively to promote the advantages of Canada, making our country an attractive destination for company expansion and investment.

On behalf of the Board of Directors, I want to thank Minister Ng for her ongoing support. Special thanks to Invest in Canada’s Executive team for their commitment to fulfilling our mandate, to interim Chief Executive Officer, Katie Curran, for her effective and compassionate oversight of the organization, and to each of our talented employees for their dedication to advancing our essential work during a time of great global uncertainty.

To my Board colleagues, thank you for your insightful leadership, sound governance and exemplary financial stewardship. It has been a great honour to serve as the Invest in Canada Board Chair.

Mitch Garber

Chair of the Board of Directors

From the Chief Executive Officer

Invest in Canada has remained steadfastly committed to ensuring Canada remained open for business throughout the pandemic, with our team seamlessly adapting our promotion and engagement tactics to attract new foreign direct investors.

Invest in Canada quickly pivoted to meet the expectations of our global clients. We hosted virtual meetings with foreign investors from across the globe, amplified our digital presence to expand our reach and provided partners with the data they need to land investments in their respective markets.

I am proud of what our team has accomplished this past year. Invest in Canada has hit its stride, humming in delivery mode. Over the years, we have established a talented team and have built up the capacity of our business units, structured to support the achievement of our priorities.

Since April 2021, we have supported the introduction of new investment capital through more deals from more countries into more sectors of our economy. We have reached over 54 million business decision-makers in over five countries and increased investor interest in Canada by 90% through our promotional efforts. We have seen investments from the Americas, Europe and Asia towards various sectors— from digital industries, life sciences and natural resources— with investments well dispersed throughout Canada.

While we continue to advocate for new investments across a broad diversity of sectors, to support our efforts in the year ahead, we are streamlining our approach by giving additional focus to three strategic sectors for investment attraction aligned with the Government of Canada’s priorities: EV battery supply chain, hydrogen and value-added agriculture.

This approach will allow us to continue to target our marketing, research and client service approaches with a clear purpose and an emphasis on generating a healthy return on our efforts.

In 2022-23, to progress these priority areas of focus, Invest in Canada will continue to promote Canada's global brand and investment advantage to the world, with an ongoing effort on diversifying entry of new market players and will work to achieve the following results:

- Canada is promoted as an attractive foreign direct investment destination

- Investors are investing or expanding in Canada through the support of Invest in Canada services

- Partners have access to services and tools to support their investment attraction efforts

These results reflect Invest in Canada’s commitment to fulfilling our mandate and providing stakeholders with a view of the organization’s priorities in the planning period.

It has been a tremendous privilege to guide Invest in Canada's strategic objectives as interim CEO. I admire how well our talented team adapted to the challenges and barriers posed by the global pandemic and look forward to supporting the organization in the years ahead.

I want to thank Minister Ng for her guidance and support and our Board of directors for their mentorship and confidence.

Katie Curran

Interim Chief Executive Officer

Plans at a glance

Since its creation in 2018, Invest in Canada (IIC) has been committed to carrying out its mandate to promote foreign direct investment (FDI) into Canada. IIC continues to coordinate efforts with partners across all orders of government, the private sector and other stakeholders to champion Canada as a premier investment destination. Leveraging its partnerships with provinces and cities across Canada, IIC has focused its efforts on building awareness of Canada's unique advantages to distinguish our value proposition from our international competitors. This positioning is instrumental to supporting the Government of Canada’s aim to drive more innovation, diversified investment and trade into the country.

Like the rest of the world, Canada continues to face the economic challenges of COVID-19. Along with other developed countries globally, FDI in Canada decreased by 53% in 2020 because of the pandemic.i This decline is a stark reality impacting developed countries across the globe. Despite early declines, Canada’s economy recovered and grew for three consecutive quarters into 2021.ii This speaks to resilience of the country’s economy; however, underscores the importance of dedicating resources that will reignite worldwide trade and investment efforts to improve the long-term health of the Canadian and global economies.

In the year ahead, IIC will continue to leverage the entrepreneurial values of the organization to expand efforts to attract new and diversified investment opportunities into regions across Canada while taking into consideration the Government of Canada’s post-pandemic recovery priorities and the objectives set forth in the Minister of International Trade, Export Promotion, Small Business and Economic Development’s portfolio mandate.

While IIC will continue to support investments across diverse sectors, the organization streamlined its approach to sectors of focus and identified three strategic sectors aligned with the Government of Canada’s priorities—EV battery supply chain, hydrogen and value-added agriculture—for additional targeted research, promotion and investment attraction in 2022-23.

These sectors are well aligned with the Government of Canada’s priorities to advance inclusive economic recovery that supports our efforts to accelerate the transition to a net-zero economy by 2050 and to solidify domestic supply chains. This focus will allow IIC to bring further rigour to our program inventory execution, maximize our fiscal responsibilities and advance the achievement of our departmental priorities.

In this context, IIC will focus on the following priorities in 2022-23 to achieve its departmental results and indicators:

Promote Canada as a top investment destination

Expanding foreign investment promotion continues to be IIC's leading priority. As Canada transitions to post-pandemic recovery, attracting new sources of investment through strategic and focused promotion and marketing efforts will be critical to successfully raising investor awareness and building long-term, mutually-beneficial economic relationships.

In 2021, IIC expanded awareness through virtual signature events and targeted marketing and promotion channels that amplified Canada’s unique value proposition to strategic global audiences. The organization’s integrated advertising campaign increased investor interest in Canada by 90%. What’s more, individual country results revealed valuable insights into target markets. This intelligence, combined with the data and research generated through IIC’s FDI information portal, InfoZone, will provide detailed analysis to inform the organization’s promotion tactics and support the work of the investor services team in 2022-23.

Support inclusive economic recovery and creation of clean jobs

The Government of Canada has communicated its commitment to building a resilient, post-pandemic economy while protecting the environment through natural resource innovation and creating jobs for Canadians. Fundamental to this work is securing critical supply chains through diversified investment.

Since April 2021, IIC has supported a steady inflow of investments that will support economic recovery and create new jobs across a host of sectors from digital industries, advanced manufacturing, agribusiness, life science, natural resources and more.

Building on this success, IIC will continue to work with partners and companies on diverse opportunities that contribute to the Canadian economy, support domestic supply chains and create jobs in clean sectors. IIC will work with provinces, territories, municipalities, Indigenous communities and the private sector to attract global capital and investors into various industries with a specific focus on low-carbon resource markets and building on Canada’s primary agricultural resources.

Advance diversified trade and investment opportunities

Building stronger economic linkages between Canada and a diverse mix of foreign investors is paramount to IIC’s work and is an integral part of Canada's export and trade diversification success.

Attracting inward FDI in an increasingly competitive global environment during the pandemic is no easy task and requires a whole-of-government approach. IIC will continue to lead the evolution and execution of Canada’s FDI Attraction Strategy in collaboration with sixteen federal organizations. The strategy will continue to emphasize coordination and cooperation across federal organizations to ensure that the right support and capacity are in place to facilitate and accelerate FDI. This collaborative effort will include participating in and collaborating on interdepartmental initiatives of shared interest.

In addition, IIC will work to support the Minister of International Trade, Export Promotion, Small Business and Economic Development’s mandate to strengthen and secure critical supply chains and advance Canada’s export diversification strategy. IIC will do this through close cooperation with the Trade Commissioner Service, leveraging their in-market expertise, and other government departments to provide complementary roles and services to potential investors.

For more information on Invest in Canada’s plans, see the “Core responsibilities: planned results and resources, and key risks” section of this plan.

Core responsibilities: planned results and resources, and key risks

This section contains information on the department’s planned results and resources for each of its core responsibilities. It also contains information on key risks related to achieving those results.

Foreign Direct Investment Attraction

Description

Invest in Canada’s (IIC) core responsibility is to lead the Government of Canada's foreign direct investment (FDI) attraction efforts by making Canada top-of-mind for foreign investors and providing services in support of investor decisions to expand in Canada.

Planning highlights

Invest in Canada has the mandate to promote FDI in Canada, attract and facilitate that investment, and coordinate FDI attraction efforts among government entities, the private sector, and other stakeholders. In doing so, IIC’s efforts will support economic prosperity and stimulate sustainable innovation in Canada.

In 2021-22, IIC undertook a review of its Departmental Results Framework to reformulate its results to be geared towards outcomes that more closely reflect the reach and the impact of the organization’s activities, while refining indicators to provide more valid, stable and available data over an extended period of time. The 2022-23 departmental plan provides the Government of Canada and parliamentarians with a view of the results that IIC intends to achieve and the means to measure and describe progress on the results. IIC’s three program areas: Marketing; Investor Services; and Data Partnerships and Pan-Canadian Collaboration, are structured to support the organization’s achievement of the following results:

Result 1: Canada is promoted as a foreign direct investment destination

IIC will build upon the strong marketing results achieved in the 2021-22 planning period by continuing to promote Canada as a top investment destination. The organization is developing a holistic promotional strategy that maximizes the combined value of marketing, advertising, events and public relations, focusing on a narrative that will attract new investments from more countries and towards Canada’s key sectors.

Further, IIC will leverage its work with other federal departments to lead the execution of Canada's FDI Attraction Strategy. The organization will work with departments to speak with one voice, aligning the promotion of Canada’s value proposition consistently, with a greater focus on Canada’s strategic areas of focus, including electric vehicle (EV) battery supply chain and hydrogen solution pitches, to better target messaging to clients.

This will be achieved by positioning the opportunities for innovation and competition in Canada’s key sectors, including the EV battery supply chain and hydrogen resource sectors. Canada will be poised as a leading low-carbon economy that welcomes investments that advance sustainable technology and manufacturing solutions. In 2022-23, Invest in Canada will continue to:

- Promote Canada’s value proposition and provide accurate and compelling information to potential global investors;

- Create targeted advertising and marketing campaigns highlighting Canada’s world-class value proposition for global companies;

- Work with partners, including the Trade Commissioner Service, to promote strategic opportunities for investment.

Result 2: Investors are investing or expanding in Canada through the support of IIC services

Despite the pandemic decline in FDI, Canada’s inward FDI sources are now more geographically diverse—40% of Canada's FDI stock comes from Europe, and one-tenth comes from Asia and Oceania.iii This data demonstrates that Canada continues to be a destination of choice for investors looking to put down roots in Canadian communities as they build and expand their companies and recruit top Canadian talent.

IIC will continue to work collaboratively with federal partners, like the Trade Commissioner Service, as well as provincial, territorial, and municipal partners to explore new investment leads while pitching value-add opportunities to existing investors. In 2022-23, Invest in Canada will:

- Support investors looking to invest in clean technology solutions by promoting the long-term economic advantages of Canada’s low-cost, high-growth hydrogen industry and “mines to mobility” EV supply chain investment opportunities, as well as the potential in value-added agriculture;

- Help global companies fast-track their investment expansion decisions by connecting firms with the right people in the right places across economic sectors; and

- Expand existing FDI by positioning the value of reinvestments or expansions among existing investors.

Result 3: Partners have access to services and tools to support their investment attraction efforts

By continuing to execute a data-driven approach to promotion efforts, we can support our partners with a clear, forward-looking roadmap of the FDI landscape to build a pipeline of investment targets to support pandemic recovery. This business intelligence will continue to support FDI into all regions across Canada, including small and rural locations often hardest hit by necessary pandemic restrictions.

IIC will continue to coordinate our efforts with federal, provincial, territorial and municipal partners to improve prospective investors’ access to a full suite of services. This suite includes data tools and information through our expanded concierge services, which provide clients with integrated and high-quality service and business intelligence. IIC will execute the FDI attraction strategy developed in collaboration with federal colleagues to strengthen coordination of roles and responsibilities to enhance service delivery to new and existing investor clients. In 2022-23 Invest in Canada will continue to:

- Build out a suite of knowledge products to promote the competitive value and high-growth market potential of various sectors, including end-to-end EV manufacturing, hydrogen investment growth opportunities and value-added agriculture;

- Carry out research focused on the impact of FDI in Canada, including the role of FDI on diversity as defined in the Canadian context as Gender Based Analysis + to better understand the impact of investments on diverse populations;

- Collaborate with our partners by providing tools and market intelligence data through InfoZone to support their investment attraction efforts; and

- Provide a one-stop-shop with partners in all orders of government to offer a seamless customer journey to simplify their investments decisions to select Canada as their preferred investment destination.

Gender-based analysis plus

An important part of Canada’s value proposition includes its diversity advantage. Many investors with whom IIC works understand that gender parity and diversity are important objectives when identifying an investment location. As part of IIC’s integrated advertising campaign and through its content marketing, IIC will continue to highlight Canada’s value proposition as a highly educated and diverse workforce.

IIC is also focused on the impact of investments in small and rural towns in Canada and will continue to collect data and research on the impacts in those areas. In the year ahead, the organization will conduct research to examine the impact of FDI in Canada, with a specific focus on the role of FDI on diverse groups, such as Indigenous populations, rural populations, integration of international students and new immigrants. This research will help the IIC better understand the impact of investments on the diverse populations or different types of businesses so that the organization can better work with investors to improve gender or diversity goals, while positioning Canada as a top-of-mind investment destination.

Invest in Canada’s long-term plan also includes its commitment to ensuring its own workforce demonstrates gender pay equity. Over the next year, IIC will complete a pay equity exercise and create a pay equity plan as outlined in the Pay Equity Act. The exercise will compare female and male dominated job classes to determine whether there are pay equity discrepancies. IIC will develop a pay equity plan to address any pay equity issues.

United Nations’ (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Invest in Canada supports the Federal Sustainable Development Strategy (FSDS) goal of transitioning to a low‑carbon economy through green procurement. Invest in Canada continues to use Public Services and Procurement Canada’s consolidated procurement instruments, which include environmental considerations and enables organizations to purchase more environmentally preferable goods and services. In support of the FSDS goal of clean growth—including the development, demonstration, commercialization, deployment, adoption and export of technologies that reduce environmental impacts—IIC is proactively targeting, promoting and attracting FDI in the clean technologies industry, with a particular focus on the EV supply chain and hydrogen economy.

Experimentation

Invest in Canada has not planned any experiments in 2022-23 as the focus remains on executing the mandate as set out in its enabling legislation. IIC will nevertheless continue to use innovative approaches to deliver services and carry out activities in support of partners and clients, such as digital marketing, regional support across Canada and building key partnerships with industry.

Key risk(s)

Like many federal entities, IIC has had to adapt to new dynamics and challenges brought on by the COVID-19 pandemic. Although this risk is beyond the control of IIC, mitigation strategies have been put in place to ensure that the organization is still able to deliver on its mandate while respecting rules and restrictions and minimizing exposure of employees to the COVID-19 virus. IIC remains fully active and engaged as the organization continues to leverage online tools to engage with companies through virtual site tours, video conferences and events, as well as by amplifying the organization’s digital presence to expand reach and provide partners with the data they need to land investments in their respective markets.

Planned results for Foreign Direct Investment Attraction

The following table shows, for Foreign Direct Investment Attraction, the planned results, the result indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental Results | Departmental result indicator | Target | Date to achieve target | 2018–19 actual result | 2019–20 actual result | 2020–21 actual result |

|---|---|---|---|---|---|---|

| Canada is promoted as a foreign direct investment destination | Number of target audience individuals exposed to IIC’s promotional activities. (content and events combined) | 1,000,000 | March 2023 | Not available* | Not available* | Not available* |

| Number of unique reach of promotional campaigns | 20,000,000 | March 2023 | Not availableFootnote * | Not availableFootnote * | Not availableFootnote * | |

| Net Promoter Score | 0 | March 2023 | Not availableFootnote * | Not availableFootnote * | Not availableFootnote * | |

| Investors are investing or expanding in Canada through the support of IIC services | Number of new investments or expansions supported by IIC | 25 | March 31, 2023 | 3 | 12 | 24 |

| Number of investors receiving IIC services | 125 | March 31, 2023 | 78 | 73 | 134 | |

| Partners have access to services and tools to support their investment attraction efforts | Number of products (Sector Fact Sheet, Reports, Data sets, etc.) developed and shared with partners | 320 | March 31, 2023 | 0 | 30 | 281 |

| Number of Federal, Provincial and City partners accessing data and information on the IIC InfoZone partner portal to support investment promotion activities. | 610 | March 31, 2023 | Not availableFootnote ** | Not availableFootnote ** | Not availableFootnote ** |

Table Footnotes

- Notes:

-

New indicators tracked as of the 2021-22 fiscal year.

-

InfoZone partner portal was launched in March 2021

The financial, human resources and performance information for the Invest in Canada’s program inventory is available on GC InfoBase.iv

Planned budgetary spending for Foreign Direct Investment Attraction

The following table shows, for Foreign Direct Investment Attraction, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending |

2023–24 planned spending |

2024–25 planned spending |

|---|---|---|---|

| $26,217,014 | $26,217,014 | $26,521,214 | $26,521,214 |

Financial, human resources and performance information for Invest in Canada’s program inventory is available on GC InfoBase.v

Planned human resources for Foreign Direct Investment Attraction

The following table shows, in full time equivalents, the human resources the department will need to fulfill this core responsibility for 2022–23 and for each of the next two fiscal years.

| 2022–23 planned full-time equivalents |

2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

|---|---|---|

| 57 | 57 | 57 |

Financial, human resources and performance information for Invest in Canada’s program inventory is available on GC InfoBase.vi

Internal Services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

Planned budgetary financial resources for Internal Services

The following table shows, for internal services, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending |

2023–24 planned spending |

2024–25 planned spending |

|---|---|---|---|

| $7,394,542 | $7,394,542 | $7,480,342 | $7,480,342 |

Planned human resources for Internal Services

The following table shows, in full time equivalents, the human resources the department will need to carry out its internal services for 2022–23 and for each of the next two fiscal years.

| 2022–23 planned full-time equivalents |

2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

|---|---|---|

| 10 | 10 | 10 |

Planned spending and human resources

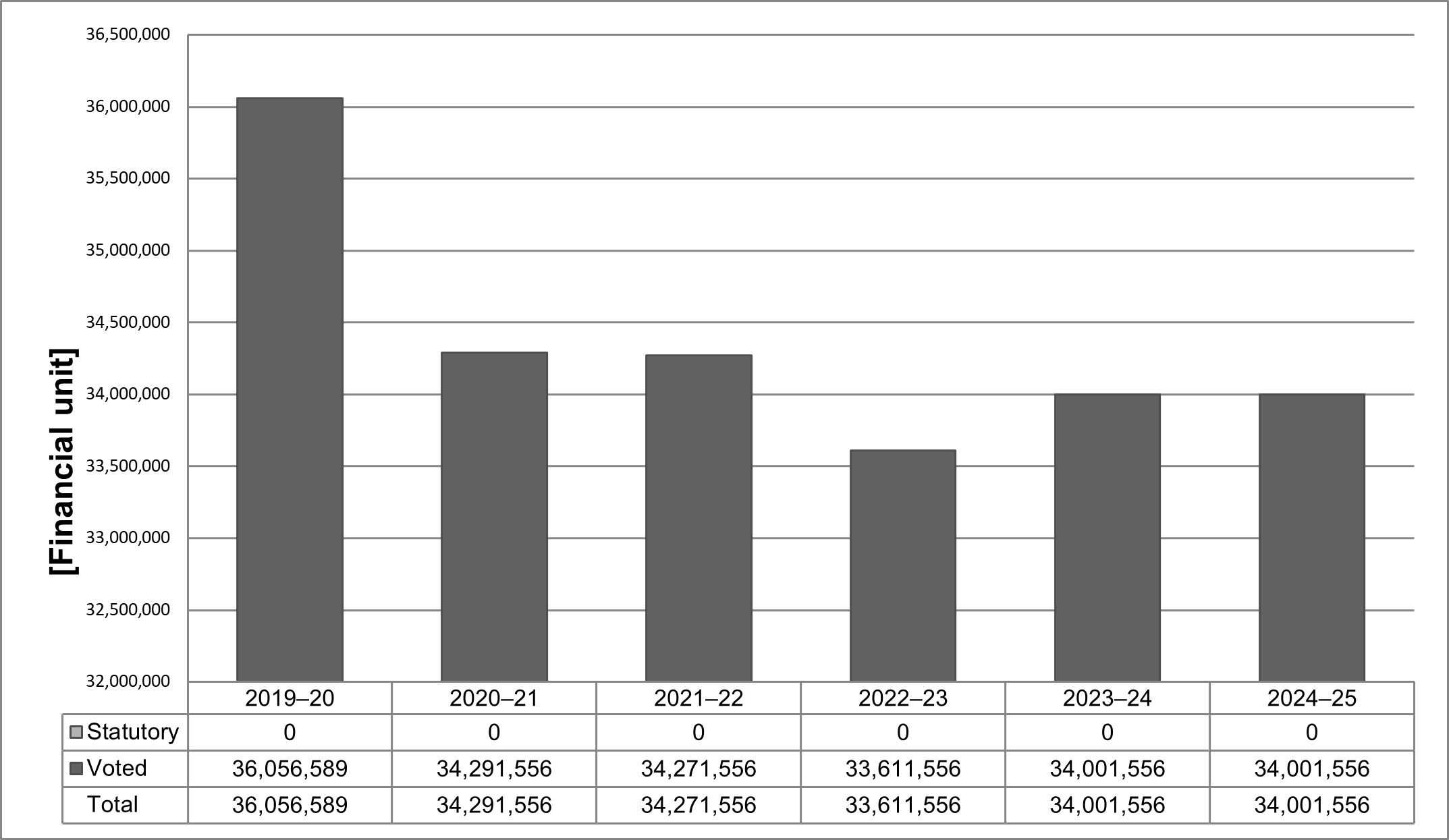

Departmental spending 2019–20 to 2024–25

The following graph presents planned spending (voted and statutory expenditures) over time.

Text version

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|---|---|---|

| Statutory | 0 | 0 | 0 | 0 | 0 | 0 |

| Voted | 36,056,589 | 34,291,556 | 34,271,556 | 33,611,556 | 34,001,556 | 34,001,556 |

| Total | 36,056,589 | 34,291,556 | 34,271,556 | 33,611,556 | 34,001,556 | 34,001,556 |

Invest in Canada’s funding profile has matched the maturation of the organization. IIC is responsible for all employee benefits and pension contributions annually.

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of Invest in Canada’s core responsibilities and for its internal services for 2022–23 and other relevant fiscal years.

| Core responsibilities and Internal Services | 2019–20 actual expenditures | 2020–21 actual expenditures | 2021–22 forecast spending | 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending |

|---|---|---|---|---|---|---|---|

| Foreign Direct Investment Attraction | $19,935,683 | $22,370,508 | 27,417,245 | $26,217,014 | $26,217,014 | $26,521,214 | $26,521,214 |

| Subtotal | $19,935,683 | $22,370,508 | $27,417,245 | $26,217,014 | $26,217,014 | $26,521,214 | $26,521,214 |

| Internal Services | $6,160,767 | $7,251,599 | $6,854,311 | $7,394,542 | $7,394,542 | $7,480,342 | $7,480,342 |

| Total | $26,096,450 | $29,622,107 | $34,271,556 | $33,611,556 | $33,611,556 | $34,001,556 | $34,001,556 |

Invest in Canada was formally established on March 12, 2018. Spending from 2021-22 to 2024 25 reflects funding for IIC at a steady state.

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of Invest in Canada’s core responsibilities and for its internal services for 2022–23 and the other relevant years.

Human resources planning summary for core responsibilities and Internal Services

| Core responsibilities and Internal Services | 2019–20 actual full time equivalents | 2020–21 actual full time equivalents | 2021–22 forecast full time equivalents | 2022–23 planned full time equivalents | 2023–24 planned full time equivalents | 2024–25 planned full time equivalents |

|---|---|---|---|---|---|---|

| Foreign Direct Investment Attraction | 49 | 57 | 57 | 57 | 57 | 57 |

| Subtotal | 49 | 57 | 57 | 57 | 57 | 57 |

| Internal Services | 7 | 10 | 10 | 10 | 10 | 10 |

| Total | 56 | 67 | 67 | 67 | 67 | 67 |

Invest in Canada was formally established on March 12, 2018. Human resources requirements from 2021-22 to 2024-25 reflects staffing for IIC at a steady state.

Estimates by vote

Information on Invest in Canada’s organizational appropriations is available in the 2022–23 Main Estimates.vii

Future-oriented condensed statement of operations

The future oriented condensed statement of operations provides an overview of Invest in Canada’s operations for 2021–22 to 2022–23.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on Invest in Canada’s website.viii

Future oriented condensed statement of operations for the year ending March 31, 2023 (dollars)

| Financial information | 2021–22 forecast results | 2022–23 planned results | Difference (2022–23 planned results minus 2021–22 forecast results) |

|---|---|---|---|

| Total expenses | $35,752,000 | $34,844,000 | $(908,000) |

| Total revenues | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | $35,572,000 | $34,844,000 | $(908,000) |

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Mary Ng, P.C., M.P.

Institutional head: Katie Curran

Ministerial portfolio: International Trade

Enabling instrument(s): Invest in Canada Actix

Year of incorporation / commencement: 2018

Other: Invest in Canada is headquartered in Ottawa and is a departmental corporation, overseen by a board of directors (the board) accountable to the Minister of International Trade, Export Promotion, Small Business and Economic Development. The board is composed of eleven (11) part-time directors, including a Chairperson, Vice-Chairperson, and an ex-officio director, the Deputy Minister of the designated Minister. Apart from the Deputy Minister, all positions are appointed by Order-in-Council to hold office for terms not exceeding three years and are eligible for reappointment in the same or another capacity. A complete list of current board appointees is available on Invest in Canada’s website.x

The board supervises and manages Invest in Canada’s business and affairs and advises the Minister and the Chief Executive Officer on matters relating to the organization’s mandate. The Chief Executive Officer is responsible for Invest in Canada’s day-to-day operation.

Invest in Canada’s enabling legislation provides the framework and powers of the organization. It also provides Invest in Canada authority over matters relating to human resources management, contracting, communications, travel and hospitality and other general administrative functions.

Invest in Canada works globally, in partnership with Global Affairs Canada and its Trade Commissioner Service, other federal departments, and provincial and municipal investment attraction offices, to promote Canada as a destination for foreign direct investment.

Raison d’être, mandate and role: who we are and what we do

Information on raison d’être, mandate and role is available on Invest in Canada’s website.xi

Information on Invest in Canada’s mandate letter commitments is available in the Minister’s mandate letter. xii

Operating context

Information on the operating context is available on Invest in Canada’s website.xiii

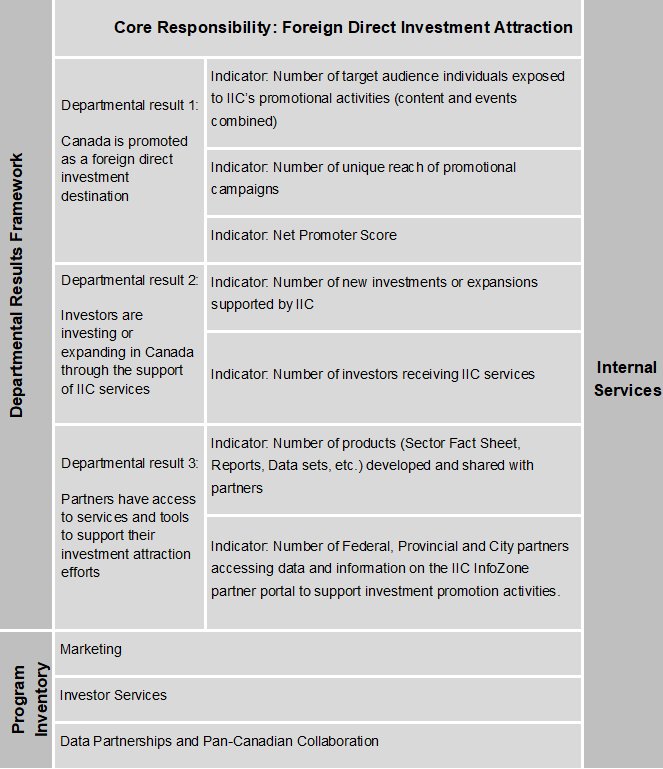

Reporting framework

Invest in Canada’s approved departmental results framework and program inventory for 2022–23 are as follows.

Text version

Departmental Results Framework / Internal Services

Core Responsibility: Foreign Direct Investment Attraction

- Departmental result 1: Canada is promoted as a foreign direct investment destination

- Indicator: Number of target audience individuals exposed to IIC’s promotional activities (content and events combined)

- Indicator: Number of unique reach of promotional campaigns

- Indicator: Net Promoter Score

- Departmental result 2: Investors are investing or expanding in Canada through the support of IIC services

- Indicator: Number of new investments or expansions supported by IIC

- Indicator: Number of investors receiving IIC services

- Departmental result 3: Partners have access to services and tools to support their investment attraction efforts

- Indicator: Number of products (Sector Fact Sheet, Reports, Data sets, etc.) developed and shared with partners

- Indicator: Number of Federal, Provincial and City partners accessing data and information on the IIC InfoZone partner portal to support investment promotion activities.

Program Inventory

- Marketing

- Investor Services

- Data Partnerships and Pan-Canadian Collaboration

Changes to the approved reporting framework since 2021–22

| Structure | 2022–23 | 2021–22 | Change | Reason for change |

|---|---|---|---|---|

| Core responsibility | Foreign Direct Investment Attraction | Foreign Direct Investment Attraction | No change | Not applicable |

| Result | Canada is promoted as a foreign direct investment destination | Canada’s brand is seen as a global leader in investment attraction | Title change | Note 1 |

| Result | Investors are investing or expanding in Canada through the support of IIC services | Canada is a location and destination of choice for global investment | Title change | Note 1 |

| Result | Partners have access to services and tools to support their investment attraction efforts | Global investors have simplified access to partners, services and tools to accelerate their investment | Title change | Note 1 |

| Indicator | Number of target audience individuals exposed to IIC’s promotional activities. (content and events combined) | Improved score in global FDI attractiveness index | Title change | Note 2 |

| Indicator | Number of unique reach of promotional campaigns | Increased awareness/recognition of the Invest in Canada brand | Title change | Note 2 |

| Indicator | Net Promoter Score | Percentage increase in “my opinion of Canada as a prominent global leader for foreign investment” | Title change | Note 2 |

| Indicator | Number of new investments or expansions supported by IIC | Percentage increase of Canada’s FDI stock | Title change | Note 2 |

| Indicator | Number of new investments or expansions supported by IIC | Increase in FDI stock from key target markets | Title change | Note 2 |

| Indicator | Number of investors receiving IIC services | Increase in FDI investments from key sectors | Title change | Note 2 |

| Indicator | Number of products (Sector Fact Sheet, Reports, Data sets, etc.) developed and shared with partners | Number of investors/decision makers using the independent Cost Comparative Analysis Tool for FDI decisions | Title change | Note 2 |

| Indicator | Number of Federal, Provincial and City partners accessing data and information on the IIC InfoZone partner portal to support investment promotion activities. | Number of partners collaborating to access, build and format data sets to be highly available to potential investors | Title change | Note 2 |

| Indicator | Number of new investments or expansions supported by IIC | Number of investment leads facilitated with partners | Title change | Note 2 |

|

Note 1: Invest in Canada undertook a review of its Departmental Results Framework in 2021 to reformulate its results to be geared towards outcomes that more closely reflect the reach and the impact of the Agency’s activities. Note 2: Results indicators were revised to provide more valid, stable and available data over a long period of time. |

||||

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to Invest in Canada’s program inventory is available on GC InfoBase.xiv

Supplementary information tables

The following supplementary information tables are available on Invest in Canada’s websitexv:

- United Nations 2030 Agenda and the Sustainable Development Goals

- Reporting on Green Procurement

- Details on transfer payment programs

- Gender-based analysis plus

- Horizontal initiatives

- Up front multi year funding

Federal tax expenditures

Invest in Canada’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government¬ wide tax expenditures each year in the Report on Federal Tax Expenditures.xvi This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

160 Elgin Street, 18th Floor

Ottawa, ON

K2P 2P7

Appendix: definitions

- appropriation (crédit)

-

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

-

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

-

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

-

A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a three year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

-

A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

-

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

-

A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

-

A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- experimentation (expérimentation)

-

The conducting of activities that explore, test and compare the effects and impacts of policies and interventions in order to inform decision-making and improve outcomes for Canadians. Experimentation is related to, but distinct from, innovation. Innovation is the trying of something new; experimentation involves a rigorous comparison of results. For example, introducing a new mobile application to communicate with Canadians can be an innovation; systematically testing the new application and comparing it against an existing website or other tools to see which one reaches more people, is experimentation.

- full time equivalent (équivalent temps plein)

-

A measure of the extent to which an employee represents a full person year charge against a departmental budget. Full time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA plus) (analyse comparative entre les sexes plus [ACS plus])

-

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race, ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

-

For the purpose of the 2022–23 Departmental Plan, government-wide priorities are the high-level themes outlining the government’s agenda in the 2021 Speech from the Throne: protecting Canadians from COVID-19; helping Canadians through the pandemic; building back better – a resiliency agenda for the middle class; the Canada we’re fighting for.

- horizontal initiative (initiative horizontale)

-

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non budgetary expenditures (dépenses non budgétaires)

-

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

-

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

-

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

-

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

-

An inventory of a department’s programs that describes how resources are organized to carry out the department’s core responsibilities and achieve its planned results.

- result (résultat)

-

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

-

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

-

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

-

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.